On Friday, the EUR declined 0.39% against the USD and closed at 1.1588, following downbeat inflation data in the common-currency region.

Consumer prices in the Euro-zone retreated 0.2% on a YoY basis in December, compared to an increase of 0.3% registered in the prior month. Inflation in the region remained below the ECB’s 2% target for the 22nd consecutive month, thus mounting pressure on the central bank to support the struggling Euro-economy.

In other economic news, Germany’s consumer price index remained steady on a monthly basis in December, in line with market expectations. In the previous month, the consumer price index had recorded an unchanged reading.

Elsewhere, in France, budget deficit widened to €90.80 billion in November, compared to a budget deficit of €84.70 billion in the previous month.

In the US, consumer prices dropped 0.4% on a monthly basis in December, recording its biggest decline in 6-years, thus bolstering the case for a delay in the timing of the Fed’s interest rate hike. In the previous month, consumer prices had eased 0.3%. Meanwhile, the preliminary Michigan consumer sentiment index surged to 11-year high reading of 98.2 in January, higher than market expected rise of 94.1 and compared to prior month’s level of 93.6.

Separately, the Minneapolis Fed President, Narayana Kocherlakota warned the central bank against the risk of raising its interest rates prematurely by stating that the Fed should keep its interest rates near zero for all of 2015. Furthermore, he urged the central bank to seriously consider the nation’s inflation data before deciding on the timings of interest rate hike in the economy.

However, the St. Louis Fed President, James Bullard reiterated that the Fed should raise its interest rates by the end of first quarter. He further stated that faster-than-expected labour market improvements suggested a need for early rate increase, while low inflation suggested otherwise. Similarly, the San Francisco Fed President, John Williams too showed his support for an interest rate hike in the nation by mid-2015. He expressed confidence in the US economy to achieve the Fed’s inflation and job-market objectives.

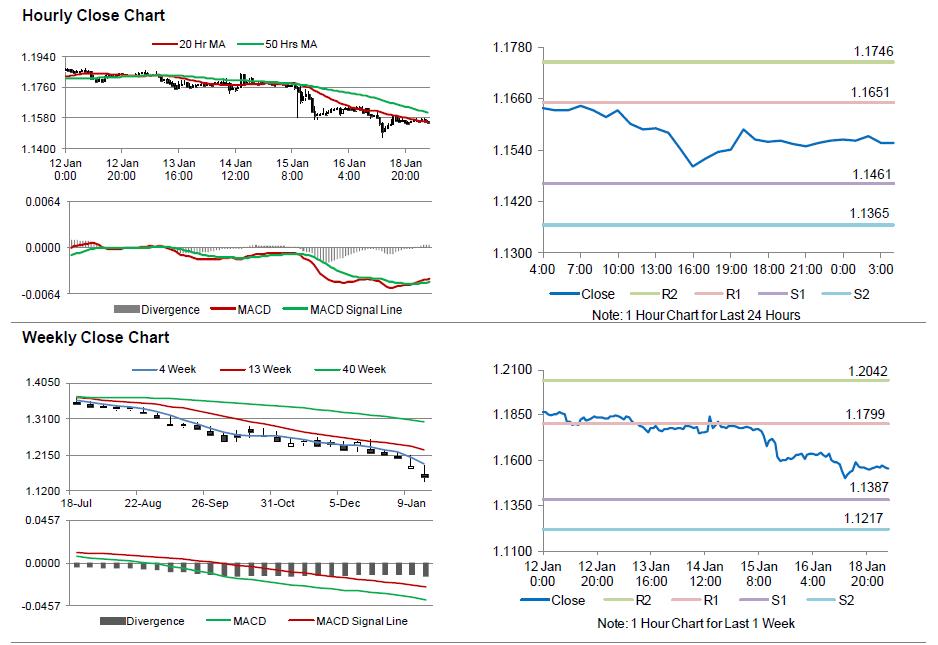

In the Asian session, at GMT0400, the pair is trading at 1.1557, with the EUR trading 0.27% lower from Friday’s close.

The pair is expected to find support at 1.1461, and a fall through could take it to the next support level of 1.1365. The pair is expected to find its first resistance at 1.1651, and a rise through could take it to the next resistance level of 1.1746.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s current account and construction output data, scheduled in few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.