For the 24 hours to 23:00 GMT, EUR declined 1.16% against the USD, on Friday, and closed at 1.4156, weighed down by rekindled worries about euro-zone sovereign debt after Greece’s credit rating was slashed.

Fitch Ratings on Friday slashed Greece’s credit rating by three notches to B+, citing its growing problems in getting its public finances in order. Euro also came under pressure, after Standard & Poor’s on Friday downgraded its outlook for Italy from “Stable” to “Negative”.

In the Euro zone, the consumer confidence rose to -9.7 in May from -11.6 in the previous month. The current account deficit contracted to €4.7 billion in March from €6.5 billion in February.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4086, 0.49% lower from the levels yesterday at 23:00GMT.

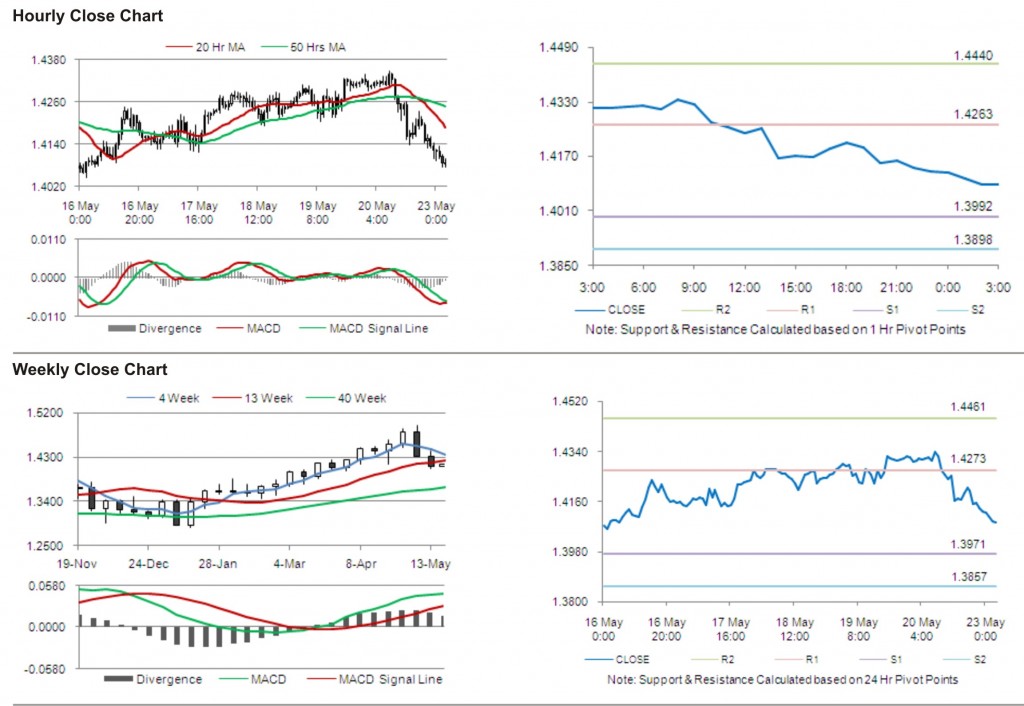

The pair has its first short term resistance at 1.4263, followed by the next resistance at 1.4440. The first support is at 1.3992, with the subsequent support at 1.3898.

Trading trends in the pair today are expected to be determined by release of services purchasing manager’s index in the Euro zone.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.