For the 24 hours to 23:00 GMT, EUR declined 0.30% against the USD and closed at 1.4393, after summit talks between France and Germany failed to quell investor concerns over the future of the 17-nation eurozone.

The German Chancellor, Angela Merkel and the French President, Nicolas Sarkozy rejected an expansion of the €440 billion rescue fund and rebuffed calls for joint Euro borrowing to end the debt crisis, saying greater economic integration was needed first. They also stated a plan to propose a tax on financial transactions in September and a new measure to require all 17 members of the Euro zone to balance their public finances before summer of 2012.

In economic news, the Gross Domestic Product (GDP) in the Euro zone rose 0.2% in the second quarter of 2011, compared to a 0.8% increase recorded in the first quarter of 2011. The trade surplus increased to €0.9 billion in June, compared to a trade surplus of €0.2 billion recorded in May.

Additionally, in German economic news, the Gross Domestic Product (GDP) rose 0.1% in the second quarter of 2011, following a downwardly revised 1.3% growth recorded in the first quarter of 2011.

Fitch Ratings affirmed the US AAA credit rating with a stable outlook, citing the nation’s ability to raise revenues and absorb another economic crisis.

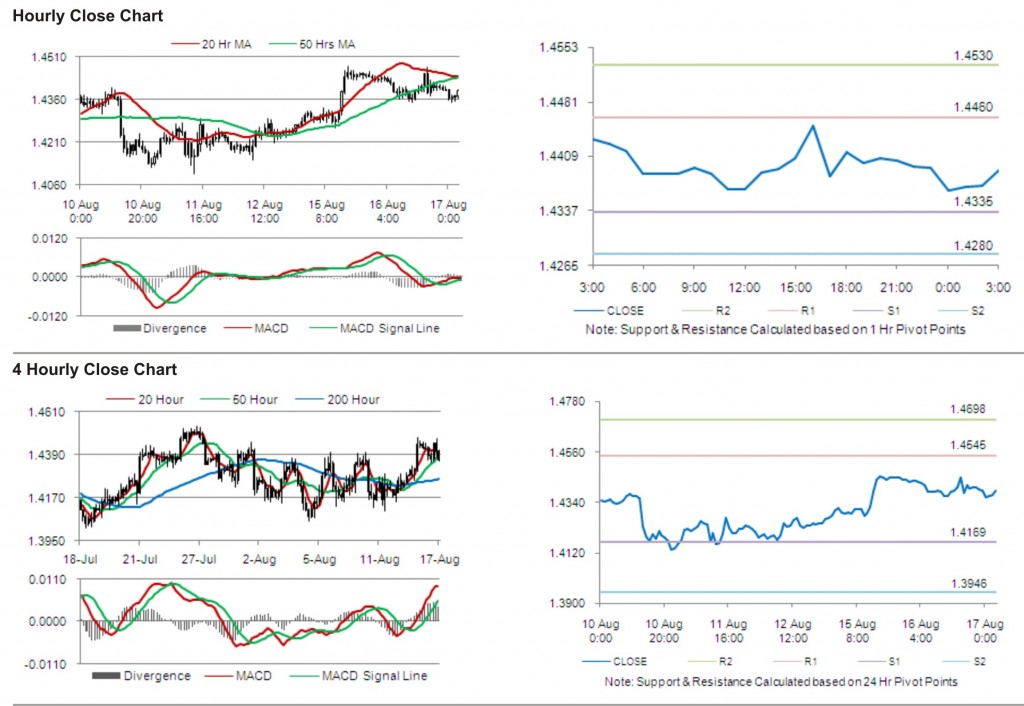

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4391, flat from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4460, followed by the next resistance at 1.4530. The first support is at 1.4335, with the subsequent support at 1.4280.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) and current account data release in the Euro zone.

The currency pair is trading below with its 20 Hr and its 50 Hr moving averages.