For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.3421. The Sentix index of investor confidence fell sharply to 2.7 in August, the lowest level in 12 months, highlighting that the sanctions imposed by them on Russia pressurized the region’s economic assessment. Analysts had estimated that the index would drop to 9 in August. Moreover, the number of people unemployed in Spain fell by 29.8K in July, much lesser than market expectations of a 116.3K decline and compared to a drop of 122.7K reported in the previous month.

However, the producer prices data from the Euro-zone somewhat eased investor concerns, after it recorded an unexpected rise of 0.1% in June for the first time this year, on a monthly basis, more than the market expectations for an unchanged reading.

In the US, the Institute for Supply Management (ISM) has reported that the New York City current business condition index rose to 68.1 in the US in July, compared to reading of 60.5 in the prior month.

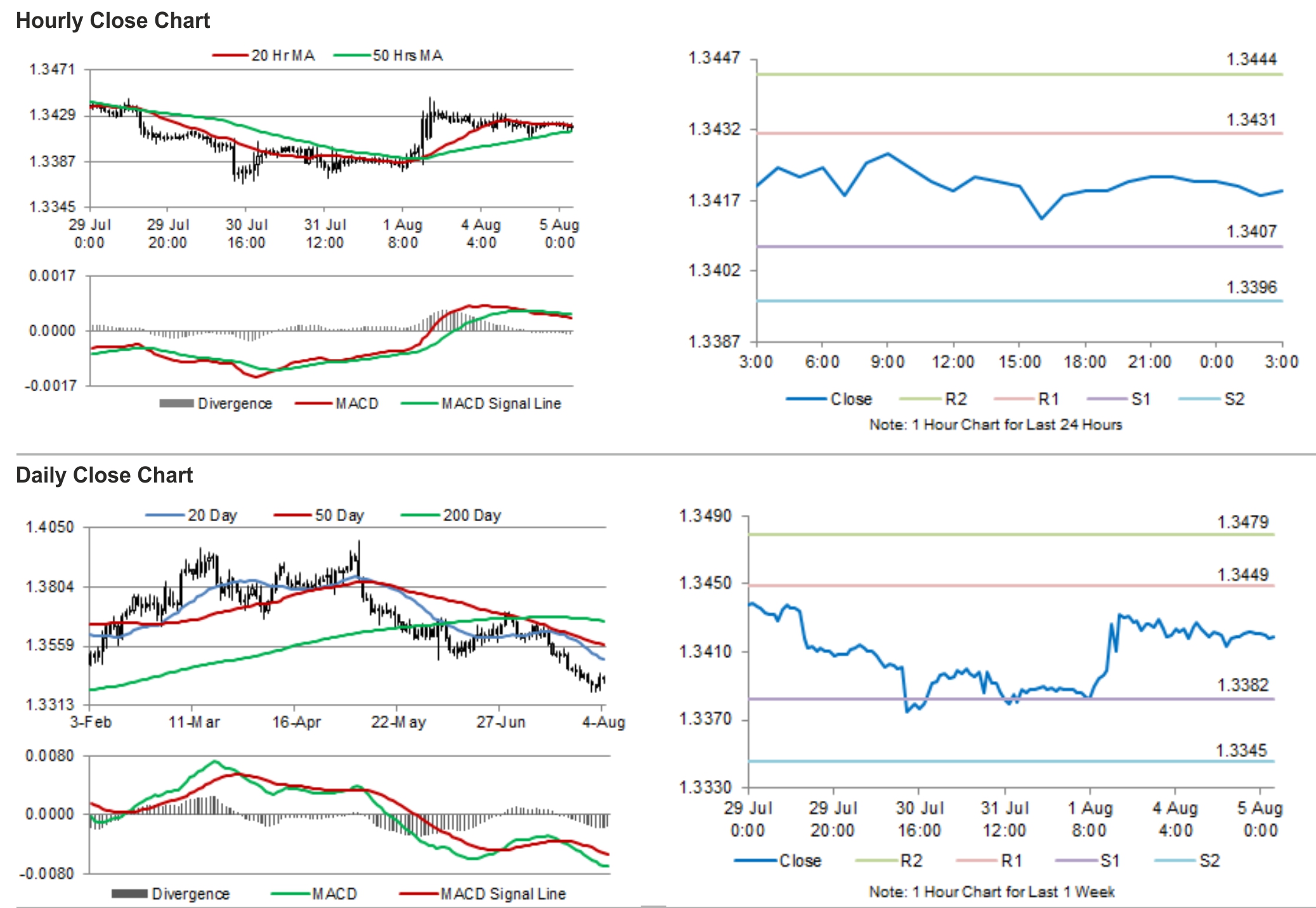

In the Asian session, at GMT0300, the pair is trading at 1.3419, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3407, and a fall through could take it to the next support level of 1.3396. The pair is expected to find its first resistance at 1.3431, and a rise through could take it to the next resistance level of 1.3444.

Today’s retail sales data from the Euro-region would determine the investor sentiments driving the Euro.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.