For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.3369, following downbeat readings on investor sentiment in the Euro-zone and Germany. The common currency also came under pressure as the ZEW indicator of economic sentiment for the Euro-zone also dropped significantly to a reading of 23.7, from 48.1 in July and against expectations of a level of 41.3. Meanwhile, the ZEW economic sentiment for Germany, Europe’s largest , also registered its eighth consecutive monthly fall in August and slipped unexpectedly to a level of 8.6, down from 27.1 a month earlier. Additionally, the current economic situation index in Germany also declined to a reading of 44.3 in August, marking the lowest level this year, compared to market expectations for a reading of 54.0. The unexpected decline is attributed to the ongoing geopolitical tensions and more importantly to sanctions imposed on Russia, Germany’s largest trading partner in Europe. In other releases, Italian consumer price index dropped 0.1% in July, from previous month’s 0.1% rise.

The US reported a budget deficit of $94.6 billion in July, compared to a surplus of $ 70.5 billion in the previous month. Markets were expecting a deficit of $96.0 billion in July. Meanwhile, the NFIB small business optimism in the US rose lesser-than-expected in July as it advanced to 95.7, from 95.0 a month ago. Analysts had expected the index to rise to 96.3 in July. Additionally, the redbook index in the US registered a rise of 1.1% in the week ended 08 August 2014, on a monthly basis, compared to a drop of 0.4% a week earlier. Job openings in the US hit a 13-year high at 4.67 million jobs in June compared to 4.58 million in May.

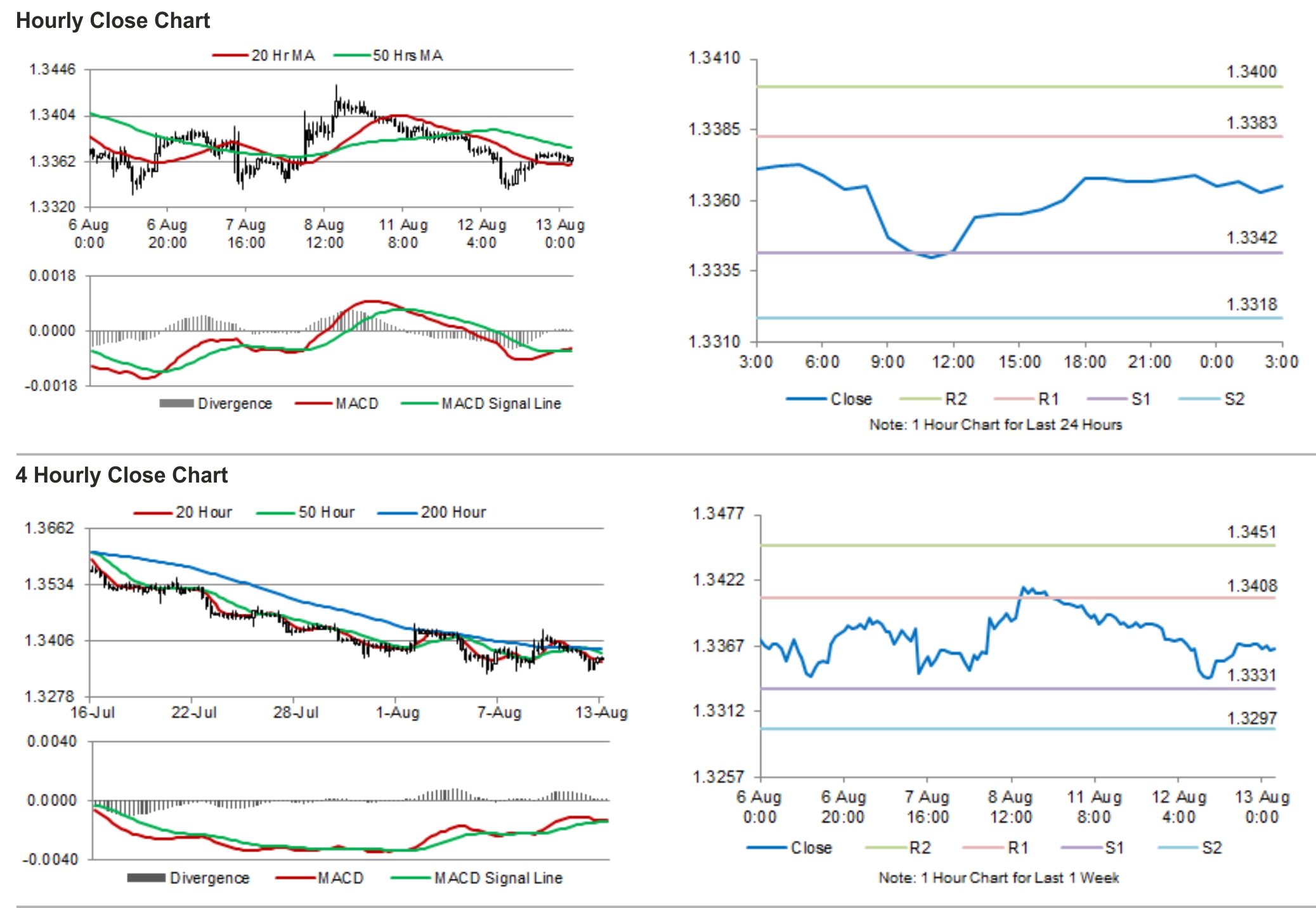

In the Asian session, at GMT0300, the pair is trading at 1.3365, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3342, and a fall through could take it to the next support level of 1.3318. The pair is expected to find its first resistance at 1.3383, and a rise through could take it to the next resistance level of 1.34.

Trading trends in Euro are expected to be determined by Euro-zone’s industrial production data, scheduled to release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.