On Friday, the EUR rose 0.28% against the USD and closed at 1.3640, as the latter came under pressure from a 2.2 points drop in the US Reuters/Michigan consumer sentiment index for May to 81.9 and as the US consumer spending fell for the first time in a year in April. However, personal income in the US rose 0.3% (MoM), in-line with market expectations for April while the Chicago business barometer rose to a seven-month high reading of 65.5 in May. Despite the recent fall in the US first-quarter GDP data, the Philadelphia Fed President, Charles Plosser, projected around 3.0% annual growth in the US economy for the rest of this year and a decline in the nation’s unemployment rate below 6.0% by the year end. However, San Francisco Fed Chief, John Williams opined that economic recovery in the world’s largest economy would be relatively gradual and as a result loose monetary policy would remain in place for a longer than expected time. Separately, in a speech at Stanford University’s Hoover Institution, Richmond Fed President, Jeffrey Lacker cautioned against Fed’s activism in credit market by stating that it would not be a part of a “sustainable, stable” role for the central bank.

Meanwhile, in the Euro-zone, an ECB Governing Council member, Ignazio Visco, hinted that the central bank was determined to act and use unconventional policy measures if forecasts confirmed inflation rate to stay below the central bank’s 2.0% target over the next two years. Separately, data from Euro-zone’s member nations showed that Germany registered an unexpected 0.9% (MoM) decline in its retail sales for April while consumer and producer prices in Italy missed marker expectations.

In a noteworthy development, the IMF expressed an optimistic outlook on Greece’s fiscal position and approved $4.64 billion bailout payment to Greece while the S&P rating agency upgraded Latvia’s credit rating to “A-” with a “Stable” outlook.

In the Asian session, at GMT0300, the pair is trading at 1.3629, with the EUR trading 0.08% lower from Friday’s close.

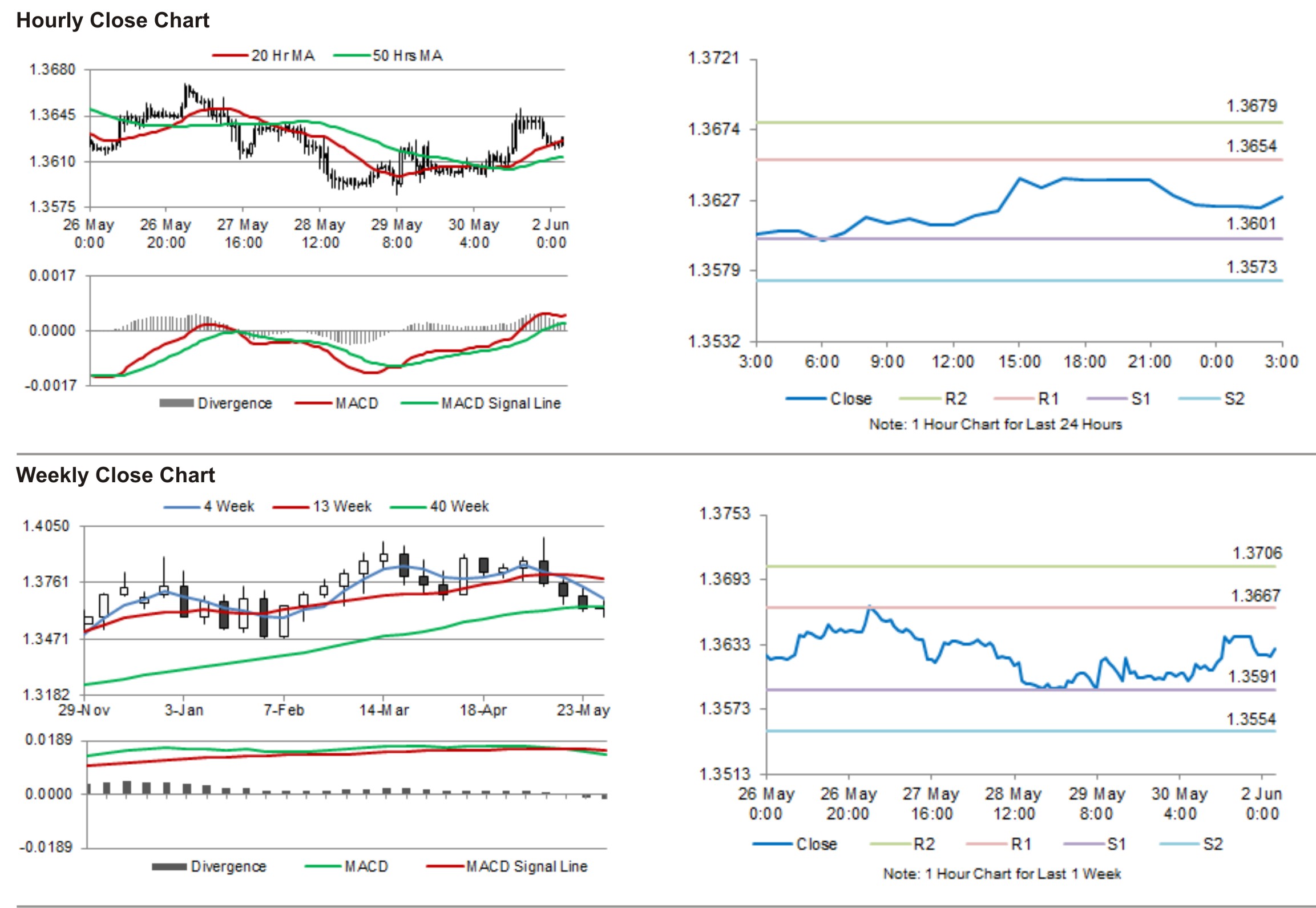

The pair is expected to find support at 1.3601, and a fall through could take it to the next support level of 1.3573. The pair is expected to find its first resistance at 1.3654, and a rise through could take it to the next resistance level of 1.3679.

During the later course of the day, traders would eye Germany’s consumer inflation data, along with Markit manufacturing PMI data for the Euro-zone and its member nations.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.