For the 24 hours to 23:00 GMT, the EUR rose 1.78% against the USD and closed at 1.1595.

In the US, the national activity index from the Chicago Fed swung back into positive territory to 0.34 in July, its best level this year, from revised reading of -0.07 recorded in June, driven by gains in production.

Fed’s Atlanta President Dennis Lockhart stated that weaker Chinese currency and further decline in oil prices have complicated the economic growth outlook for the nation, however he expects a rate hike later this year. Further he anticipates consumer and investment spending and wages to improve gradually.

In the Asian session, at GMT0300, the pair is trading at 1.1536, with the EUR trading 0.51% lower from yesterday’s close.

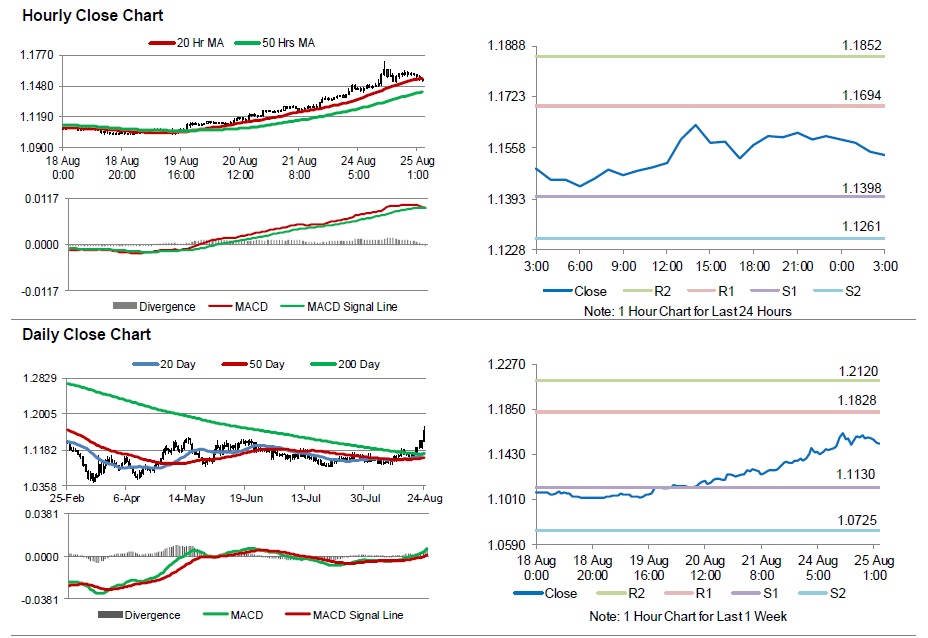

The pair is expected to find support at 1.1398, and a fall through could take it to the next support level of 1.1261. The pair is expected to find its first resistance at 1.1694, and a rise through could take it to the next resistance level of 1.1852.

Trading trends in the Euro today are expected to be determined by Q2 GDP figures as well as IFO survey data for August, set for release in a few hours. Elsewhere, services PMI and consumer confidence data, both for August in the US, would also be keenly awaited by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.