For the 24 hours to 23:00 GMT, the EUR rose 0.20% against the USD and closed at 1.1597.

In the US, data showed that, US existing home sales unexpectedly slid 0.7% to a level of 5.34 million on monthly basis in July, declining for the fourth straight month and marking its weakest pace in two years. In the prior month, existing home sales had recorded a reading of 5.38 million, while market participants had envisaged for an advance to a level of 5.40 million. On the other hand, the nation’s mortgage applications rebounded 4.2% on a weekly basis in the week ended 17 August 2018, following a drop of 2.0% in the prior week.

Separately, the Federal Reserve’s latest monetary policy meeting minutes, indicated that further gradual increases in the target range for the federal funds rate would be consistent. The officials stated that the US GDP growth would slow in the second half of 2018 but remain above potential. Further, the members pointed that ongoing global trade tensions would be the biggest threat to otherwise strong US economic growth.

In the Asian session, at GMT0300, the pair is trading at 1.1553, with the EUR trading 0.38% lower against the USD from yesterday’s close.

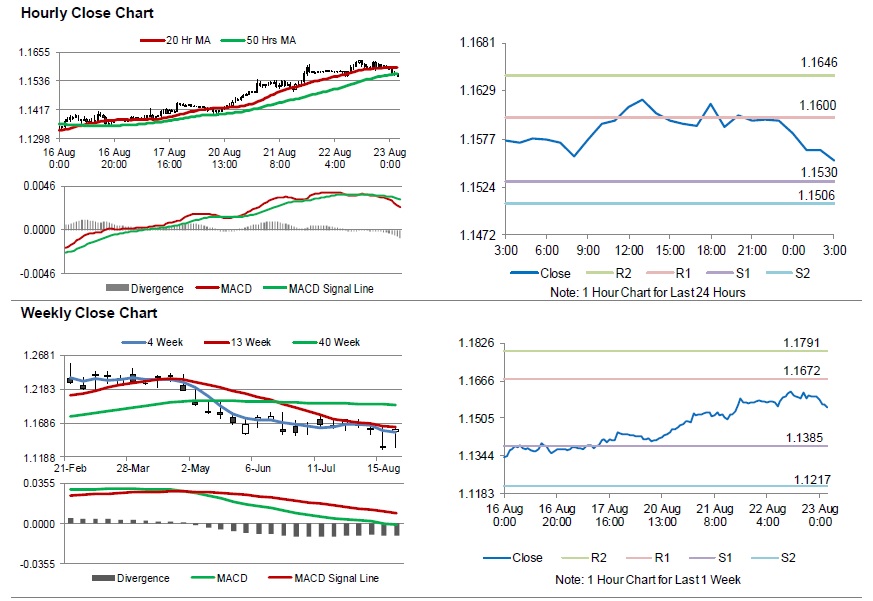

The pair is expected to find support at 1.1530, and a fall through could take it to the next support level of 1.1506. The pair is expected to find its first resistance at 1.1600, and a rise through could take it to the next resistance level of 1.1646.

Moving ahead, investors will await the Markit manufacturing and services PMI for August set to release across the euro bloc. Also, the Eurozone’s consumer confidence for August due to release later in the day, will garner significant amount for trader’s attention. Later in the day, the US house price index for June along with new home sales for July and the Markit services PMI for August, will keep investors on their toes. Additionally, the US initial jobless claims will be on investor’s radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.