On Friday, EUR rose 0.12% against the USD and closed at 1.2951, after in Germany, Euro-zone’s biggest economy, the industrial production rose 1.9%, on a monthly basis, in July, marking its biggest rise since March 2012, higher than market expectations for an advance of 0.4% and compared to a similar increase in the previous month. Meanwhile, the Euro-zone GDP stagnated on a quarterly basis, in 2Q 2014, in-line with analysts’ expectations.

The US Dollar lost ground, after the US reported disappointing August non-farm payrolls data dampened the optimism over the strength of the US labour market. The non-farm payrolls advanced to 142,000 in August, below market expectations for an increase of 230,000 and down from previous month’s 212,000. Meanwhile, the unemployment rate in the nation dipped to 6.1% in August, in line with market estimates, following 6.2% in July.

Over the weekend, the Philadelphia Fed President, Charles Plosser, stated that the Fed needs to raise the benchmark interest rates “sooner” and “gradually” in order to keep the US economy functioning smoothly.

In the Asian session, at GMT0300, the pair is trading at 1.2950, with the EUR trading tad lower from Friday’s close.

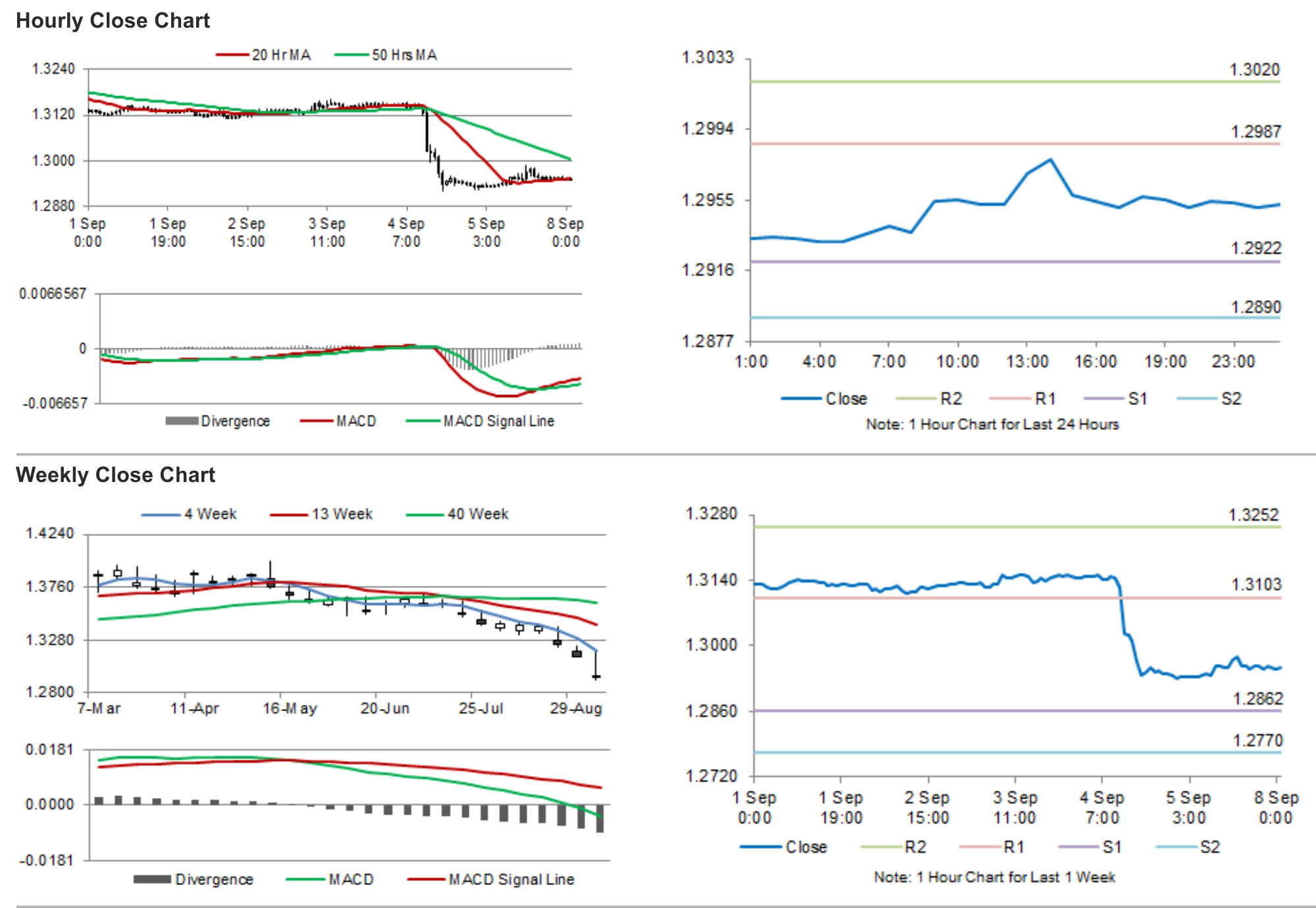

The pair is expected to find support at 1.2924, and a fall through could take it to the next support level of 1.2897. The pair is expected to find its first resistance at 1.2983, and a rise through could take it to the next resistance level of 1.3015.

Trading trends in the Euro today are expected to be determined by the German trade balance and the Euro-zone’s Sentix investor confidence, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.