For the 24 hours to 23:00 GMT, the EUR rose 0.82% against the USD and closed at 1.1133 on Friday.

In the US, personal income rose 0.6% on a monthly basis in February, more than market expectations for an advance of 0.4% and compared to a rise of 0.6% in the previous month. Additionally, personal spending increased 0.2% in February, in line with market expectations and compared to an advance of 0.2% in the prior month. Meanwhile, the Michigan consumer sentiment index dropped to 89.1 in March, hitting its lowest level since October 2016 and compared to a level of 101.0 in the previous month. The preliminary figures had indicated a fall to 95.9.

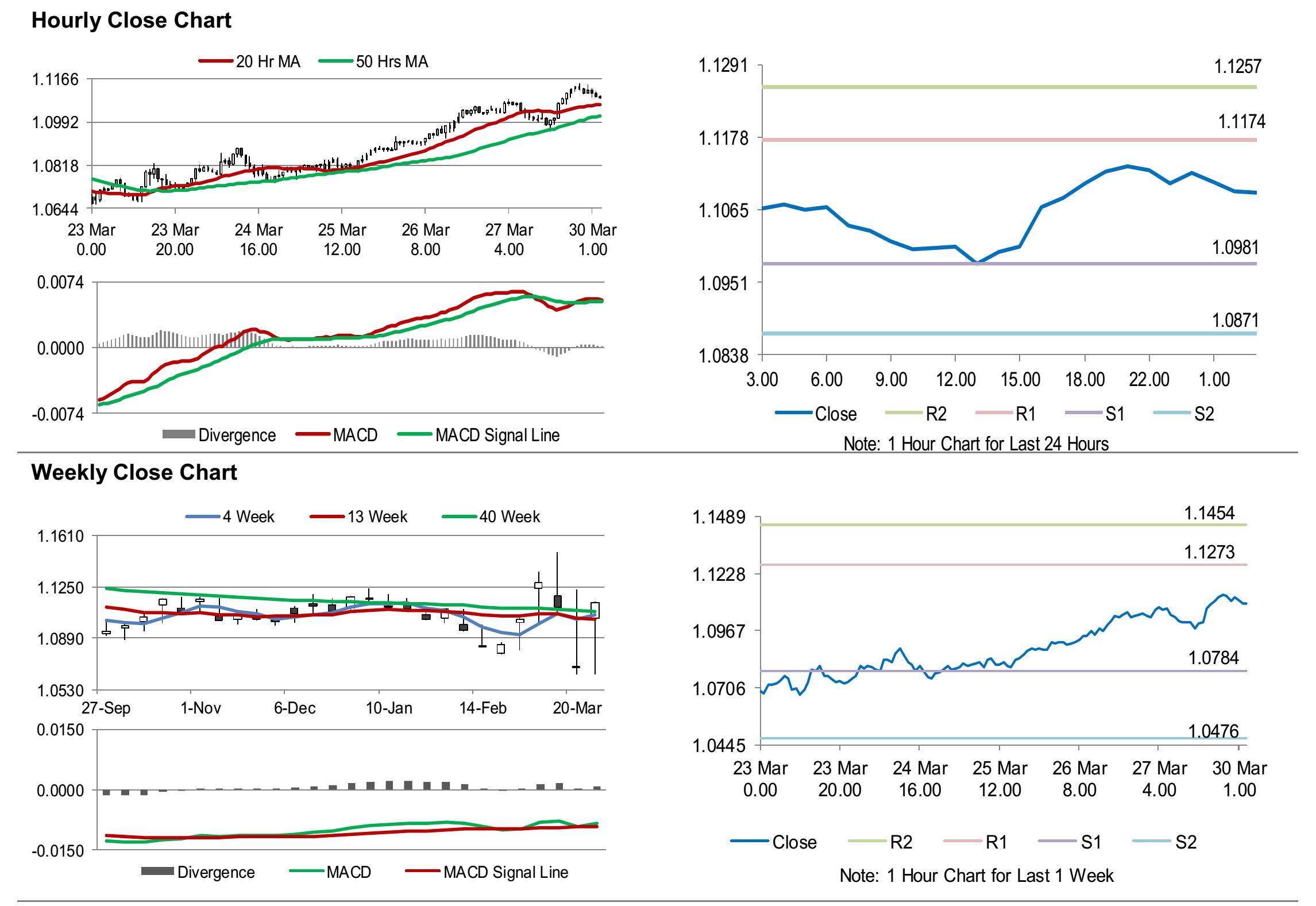

In the Asian session, at GMT0300, the pair is trading at 1.1091, with the EUR trading 0.38% lower against the USD from Friday’s close.

The pair is expected to find support at 1.0981, and a fall through could take it to the next support level of 1.0871. The pair is expected to find its first resistance at 1.1174, and a rise through could take it to the next resistance level of 1.1257.

Moving ahead, investors would keep a watch on Euro-zone’s consumer confidence, business climate and the economic sentiment indicator, all for March along with Germany’s consumer price index, for March, slated to release later today. Later in the day, the US Dallas Fed manufacturing business index for March, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.