For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.2317, after the Euro-zone’s Sentix investor confidence improved to -2.5 in December, marking its highest level in four months, higher than market expectations of a rise to -9.0 and following a reading of -11.9 registered in November.

In other economic news, the seasonally adjusted German industrial production advanced 0.2% on a monthly basis in October, lower than market forecasts to climb 0.4% and compared to a revised advance of 1.1% registered in the previous month.

Elsewhere, in France, the business sentiment index surprisingly climbed to a level of 97.0 in November, from previous month’s reading of 96.0.

Separately, the ECB’s Governing Council Member, Edward Nowotny opined that there was “high probability” that the region’s inflation growth would further slowdown in Q1 2015. Meanwhile, the OECD noted that growth in the Euro-zone would further slow down and the region was at a risk of “sliding back into contraction.”

In the US, the Atlanta Fed President, Dennis Lockhart, expressed his confidence in the US economy and stated that he expects the central bank to begin increasing interest rates in the latter half of 2015.

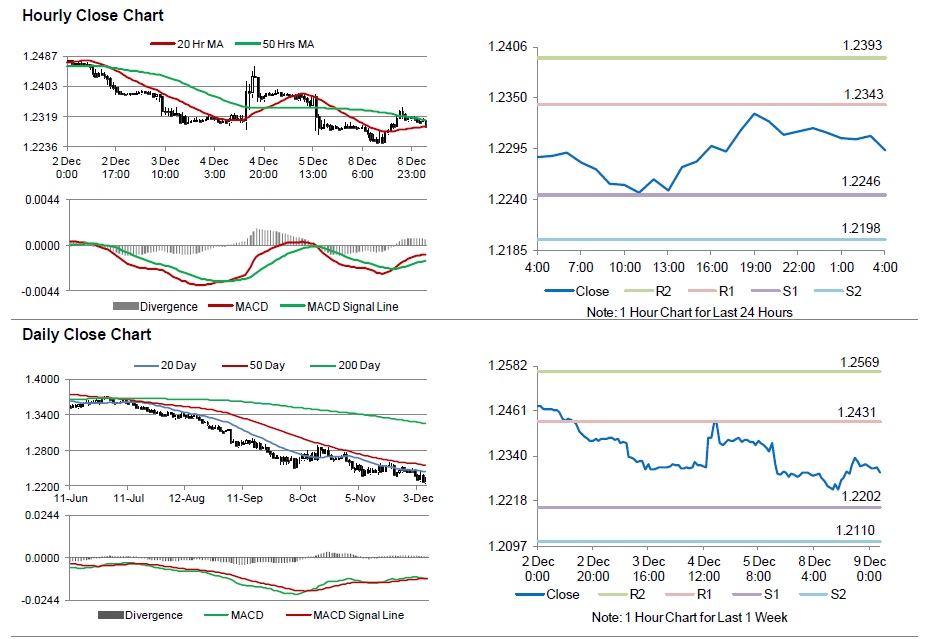

In the Asian session, at GMT0400, the pair is trading at 1.2294, with the EUR trading 0.19% lower from yesterday’s close.

The pair is expected to find support at 1.2246, and a fall through could take it to the next support level of 1.2198. The pair is expected to find its first resistance at 1.2343, and a rise through could take it to the next resistance level of 1.2393.

Trading trends in the Euro today are expected to be determined by Germany’s trade balance data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.