On Friday, EUR rose 0.39% against the USD and closed at 1.2453.

In economic news, the seasonally adjusted industrial production in the Euro-zone advanced less than expected 0.1% on a MoM basis in October, against market expectations for a 0.2% increase and compared to a revised rise of 0.5% in the preceding month. Meanwhile, the number of employed people in the single-currency region climbed 0.2% on a quarterly basis in 3Q 2014, following a revised advance of 0.3% registered in the prior quarter.

Elsewhere, in Germany, the wholesale price index dropped 0.7% on a monthly basis in November. In the previous month, the wholesale price index had dropped 0.6%. Meanwhile, current account deficit in France narrowed to €0.9 billion in October, from previous month’s deficit of €1.2 billion. In other economic news, inflation in Italy fell 0.2% on a monthly basis in November, at par with market expectations.

In the US, the Reuters/University of Michigan consumer sentiment index surged to a level of 93.8 in December, posting its highest reading since January 2007 and compared to a level of 88.8 in the prior month. Markets were anticipating the consumer sentiment index to climb to 89.5. Meanwhile, producer price index dropped 0.2% on a monthly basis, more than market expectations for a drop of 0.1%. In the prior month, producer price had climbed 0.2%.

In the Asian session, at GMT0400, the pair is trading at 1.2437, with the EUR trading 0.13% lower from Friday’s close.

Late Friday, Fitch cut France’s credit rating by a notch to AA from AA+.

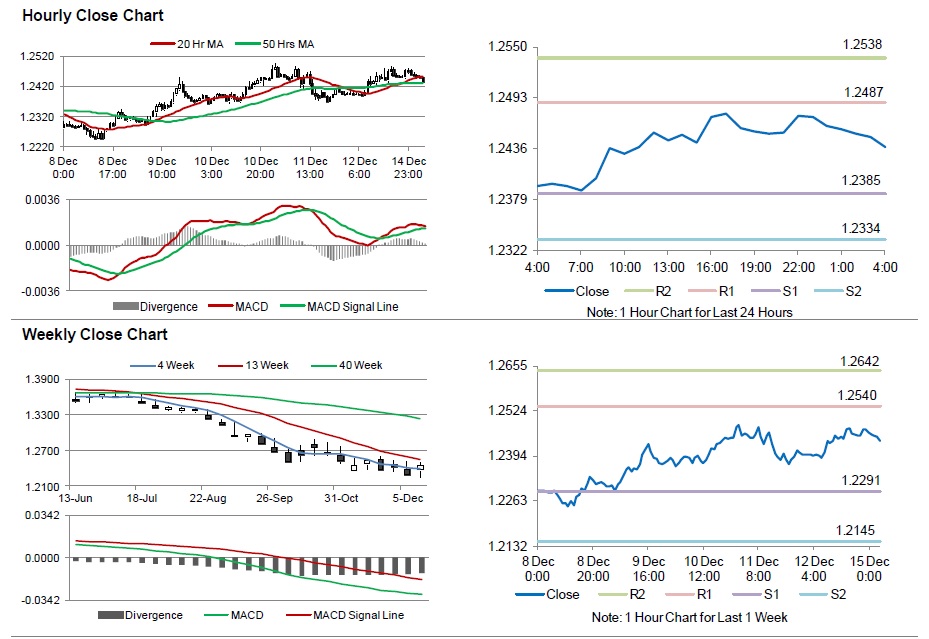

The pair is expected to find support at 1.2385, and a fall through could take it to the next support level of 1.2334. The pair is expected to find its first resistance at 1.2487, and a rise through could take it to the next resistance level of 1.2538.

Trading trends in the pair today are expected to be determined by the US industrial as well as manufacturing production data, scheduled later today.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.