For the 24 hours to 23:00 GMT, the EUR traded a tad higher against the USD and closed at 1.1013.

Yesterday, economic data showed that Germany’s ZEW economic sentiment index eased to a level of 29.7 in July, compared to a level of 31.5 in the prior month, while markets expected it to drop to a level of 29.0. Meanwhile, the final estimate of the nation’s consumer price inflation slid 0.10% MoM in June, following a rise of 0.10% in the prior month.

Other data showed that the Euro-zone’s ZEW economic sentiment index fell to 42.70 in July, compared to a level of 53.70 in the previous month, while industrial production retreated 0.4% on a monthly basis in May, reversing market forecasts for a 0.2% increase. It followed an increase of 0.1% in the previous month.

Meanwhile, Greece’s PM, Alexis Tsipras has to make the harsh reform proposals pass through the nation’s Parliament in order to secure the emergency funds from its creditors and to proceed for further financial aid.

In the US, advance retail sales surprisingly declined 0.3% in June, compared to the revised 1% pick-up registered in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0996, with the EUR trading 0.15% lower from yesterday’s close.

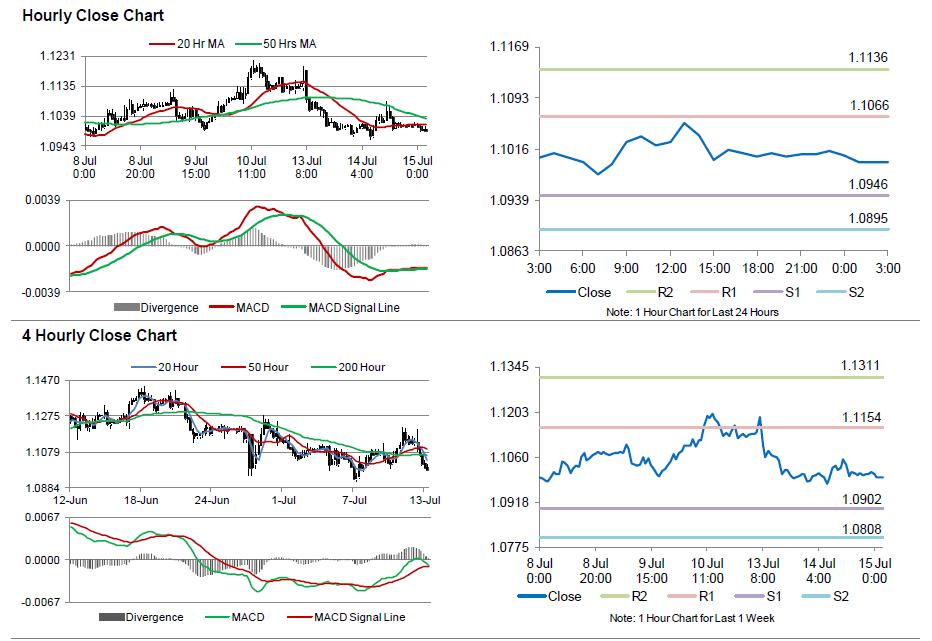

The pair is expected to find support at 1.0946, and a fall through could take it to the next support level of 1.0895. The pair is expected to find its first resistance at 1.1066, and a rise through could take it to the next resistance level of 1.1136.

Trading trends in the Euro today are expected to be determined by Greece’s parliament approval of reforms, scheduled today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.