For the 24 hours to 23:00 GMT, the EUR rose 0.05% against the USD and closed at 1.1415.

In the US, industrial production climbed 5.4% on a monthly basis in June, more than market forecast for a rise of 4.3% and compared to a rise of 1.4% in the prior month. Additionally, the NY Empire State manufacturing index jumped to 17.2 in July, more than market expectations for a rise to a level of 10.0 and compared to a reading of -0.2 in the earlier month. Moreover, the MBA mortgage applications advanced 5.1% in the week ended 10 July 2020, compared to a rise of 2.2% in the prior week. Furthermore, manufacturing production climbed 7.2% on a monthly basis in May, compared to a rise of 3.8% in the prior month.

The US Federal Reserve, in its latest Beige Book, indicated that the US economic activity increased in almost all districts but remained well below pre-pandemic levels. The report highlighted that consumer spending picked up and retail sales rose in all districts. Also, employment increased and manufacturing activity improved. Meanwhile, the Fed reiterated that the outlook remained highly uncertain as it was unclear how long the crisis would last.

In the Asian session, at GMT0300, the pair is trading at 1.1404, with the EUR trading 0.10% lower against the USD from yesterday’s close.

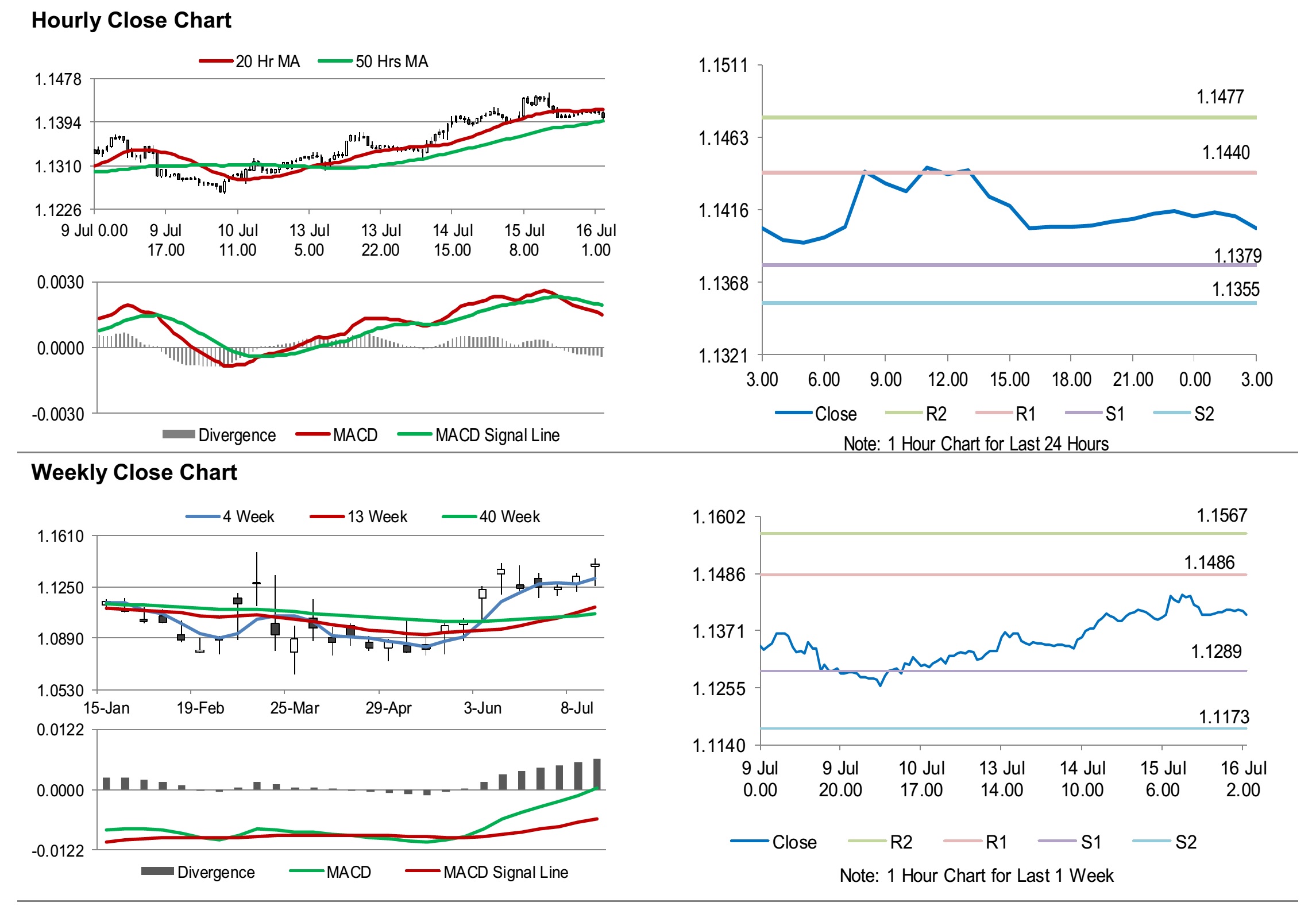

The pair is expected to find support at 1.1379, and a fall through could take it to the next support level of 1.1355. The pair is expected to find its first resistance at 1.1440, and a rise through could take it to the next resistance level of 1.1477.

Going ahead, traders would keep a watch on Euro-zone’s trade balance for May, followed by the European Central Bank interest rate decision, slated to release later today. In the US, the Philadelphia Fed manufacturing survey and the NAHB housing market index, both for May, along with business inventories for July, would keep investors on their toes.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.