For the 24 hours to 23:00 GMT, the EUR rose 0.60% against the USD and closed at 1.1760.

On the macro front, Germany’s Ifo business climate climbed to 90.5 in July, more than market expectations for a rise to a level of 89.3 and compared to a revised reading of 86.3 in the prior month. Additionally, the Ifo expectations rose to 97.0 in July, surpassing market forecast for a rise to a level of 93.7 and compared to a revised reading of 91.6 in the prior month. Meanwhile, the Ifo current assessment index advanced to 84.5 in July, less than market anticipations for a rise to a level of 85.0 and compared to a reading of 81.3 in the earlier month.

In the US, durable goods orders climbed 7.3% in June, more than market expectations for a rise of 7.2% and compared to a revised jump of 15.1% in the previous month. Additionally, the Dallas Fed manufacturing business index rose to -3.0 in July, compared to a reading of -6.1 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1746, with the EUR trading 0.12% lower against the USD from yesterday’s close.

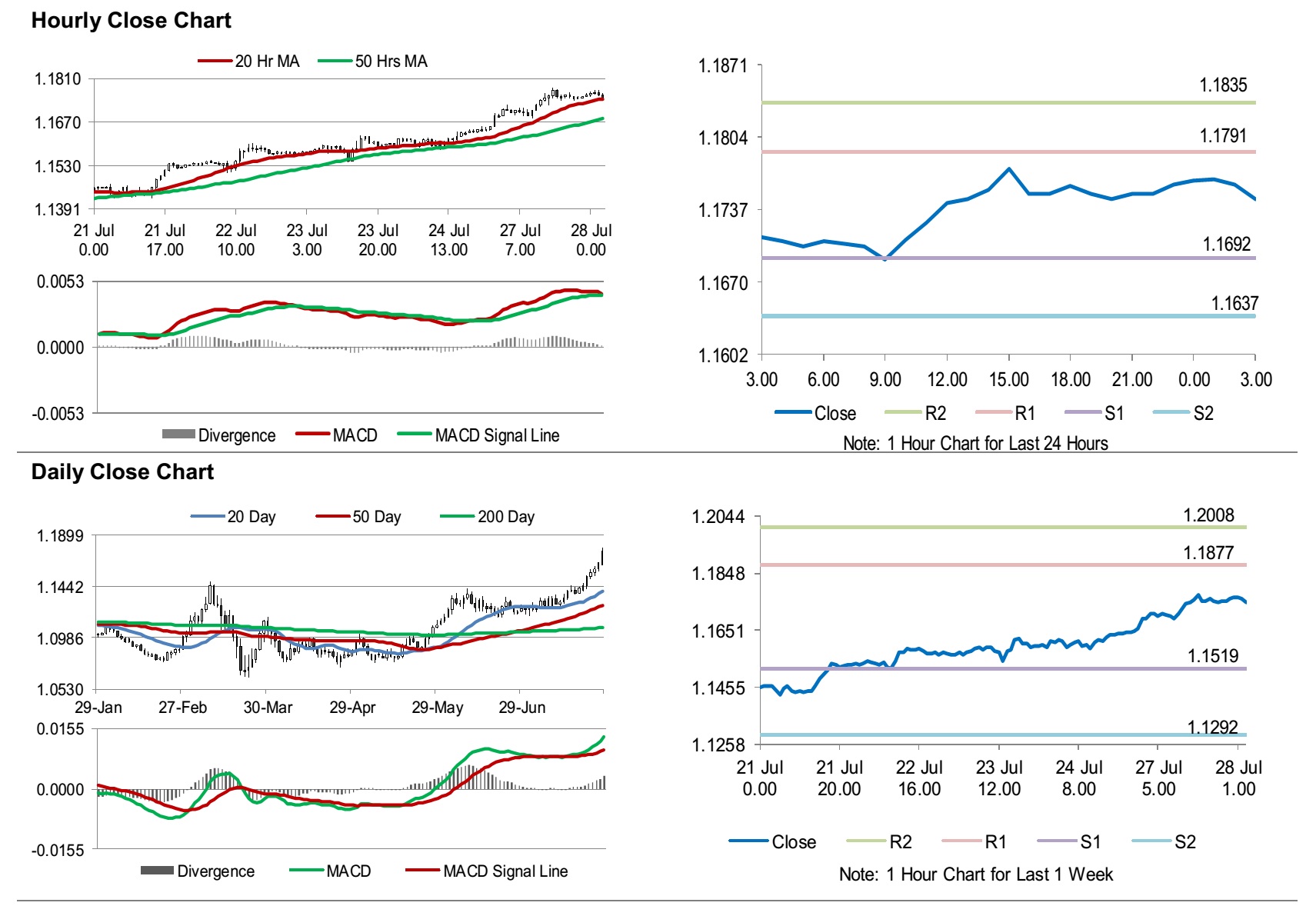

The pair is expected to find support at 1.1692, and a fall through could take it to the next support level of 1.1637. The pair is expected to find its first resistance at 1.1791, and a rise through could take it to the next resistance level of 1.1835.

In absence of key macroeconomic releases in the Euro-zone today, investors would direct their attention to the US Richmond Fed manufacturing index and consumer confidence, both for July, slated to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.