For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.0756, after Germany’s trade surplus rose more-than-expected in September.

Data showed that Germany’s trade surplus increased to a level of €22.9 billion in September, from a downwardly revised trade surplus of €15.4 billion in the previous month. Markets were anticipating the nation to record a trade surplus of €20.0 billion. Moreover, Euro-zone’s Sentix investor confidence index rose to a 3-month high level of 15.1 in November, from a reading of 11.7 in the previous month. Investors had expected it to rise to a level of 13.2.

In the US, labour market conditions index rose less-than-expected to a level of 1.6 in October, from a reading of 1.3 in the previous month. Market participants had expected it to rise to a level of 1.9.

Separately, the Organisation for Economic Co-operation and Development (OECD), trimmed its global GDP forecast to 2.9%, from its earlier prediction of 3%, given the trade slowdown in China. It further stated that global growth is expected to strengthen gradually to 3.3% and 3.6%, in 2016 and 2017 respectively, but further warned that this would require the Chinese trade activity to strengthen and also called for more investment in developed economies. Additionally, the OECD mentioned that US Federal Reserve should go ahead with an interest rate hike, as the US and European economic growth is likely to get back on track.

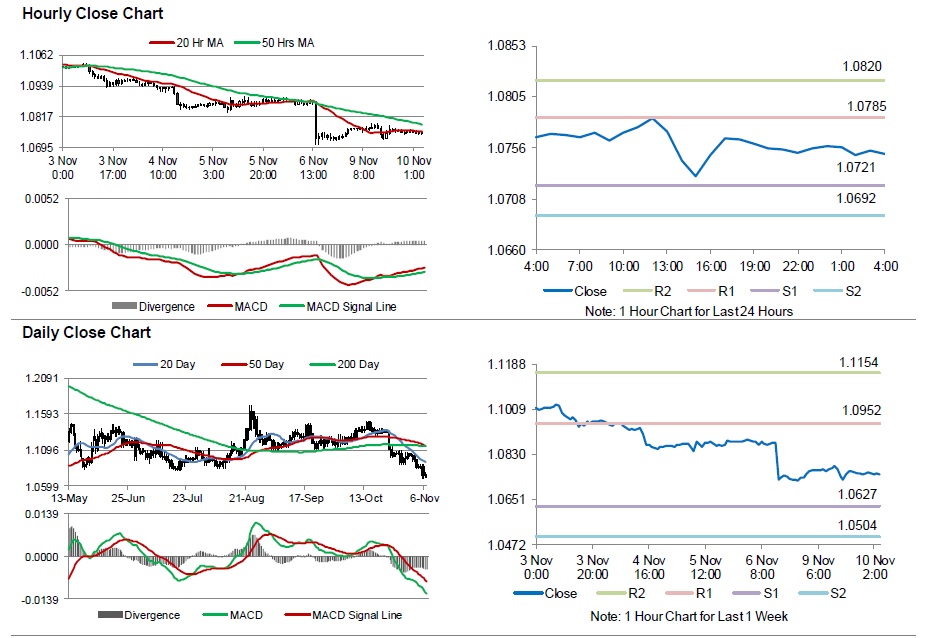

In the Asian session, at GMT0400, the pair is trading at 1.0751, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0721, and a fall through could take it to the next support level of 1.0692. The pair is expected to find its first resistance at 1.0785, and a rise through could take it to the next resistance level of 1.0820.

Going ahead, investors will look forward to France and Italy’s industrial output data for September, scheduled to be released in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.