For the 24 hours to 23:00 GMT, the EUR rose 0.86% against the USD and closed at 1.1213 as deflation fears retreated in the euro region after Euro-zone’s preliminary consumer price index remained flat YoY in April, compared to a drop of 0.10% in the prior month. Meanwhile, the region’s unemployment rate unexpectedly remained steady at 11.3% in March.

Other economic data showed that, Germany’s jobless rate remained unchanged at 6.40% in April, at par with market expectations. Meanwhile, retail sales in the nation dropped 2.3%, registering its biggest monthly drop since the end of 2013 in March, reversing market expectations for a 0.5% rise and compared to a revised fall of 0.1% in the previous month.

In the US, initial jobless claims dropped to its lowest level in 15 years to a level of 262,000 in the week ended 25 April, compared to a revised reading of 296.00 K in the prior week. Market anticipation was for it to drop to 290.00 K.

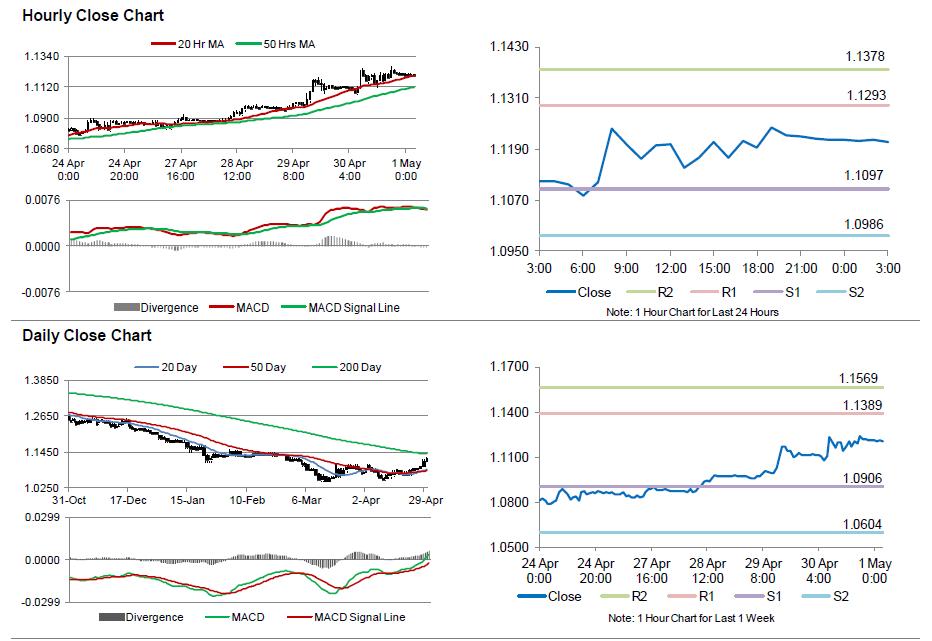

In the Asian session, at GMT0300, the pair is trading at 1.1208, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1097, and a fall through could take it to the next support level of 1.0986. The pair is expected to find its first resistance at 1.1293, and a rise through could take it to the next resistance level of 1.1378.

Amid a thin trading session in Europe on account of Labour day, investor sentiment would be determined by global macroeconomic news. Meanwhile, the US ISM manufacturing data, scheduled later today would grab lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.