For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.1560

The US dollar gained ground against the basket of currencies, after the US President Donald Trump called for softer restrictions on Chinese investments.

In the US, the flash durable goods orders slid 0.6% on a monthly basis, compared to a revised drop of 1.0% in the prior month. Market participants had expected durable goods orders to fall 1.0%. Moreover, the nation’s advance goods trade deficit narrowed to $64.8 billion in May, while markets had anticipated a trade deficit of $69.0 billion. In the previous month, the nation had recorded a revised trade deficit of $67.3 billion.

Further, the US MBA mortgage applications declined by 4.9% in the week ended 22 June, marking its highest fall in 4-months, after registering a rise of 5.1% in the previous week. Pending home sales unexpectedly eased 0.5% on a monthly basis in May, defying market expectations for a rise of 0.5%. In the prior month, pending home sales fell 1.3%.

In the Asian session, at GMT0300, the pair is trading at 1.1571, with the EUR trading 0.10% higher against the USD from yesterday’s close.

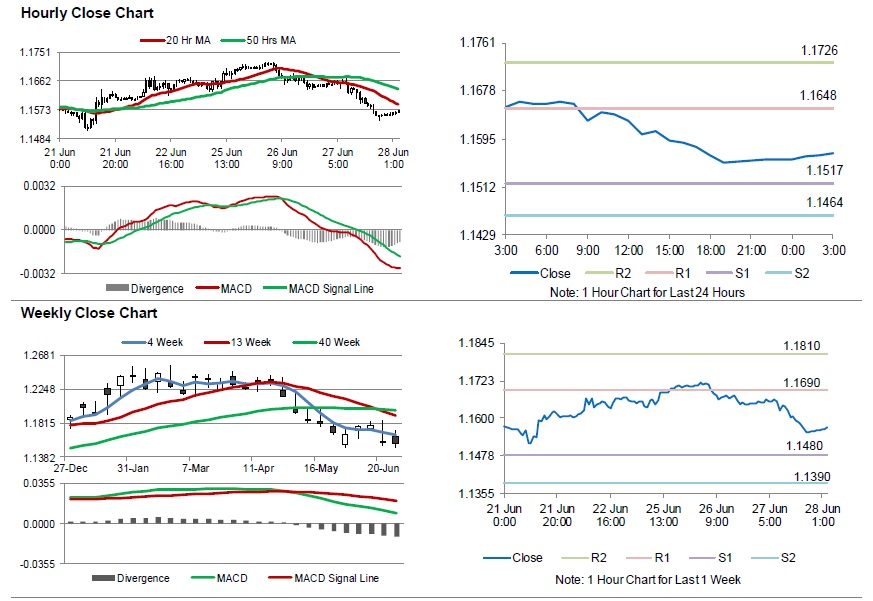

The pair is expected to find support at 1.1517, and a fall through could take it to the next support level of 1.1464. The pair is expected to find its first resistance at 1.1648, and a rise through could take it to the next resistance level of 1.1726.

Moving ahead, investors will closely monitor the Euro-zone’s consumer confidence, economic confidence and business climate indicator, all for June, due to be released in a few hours. Also, the US initial jobless claims and annualised 1Q GDP, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.