For the 24 hours to 23:00 GMT, the EUR declined 0.51% against the USD and closed at 1.1499.

In the US, data revealed that the US number of Americans filing applications for fresh jobless benefits dropped to a one-month low level of 216.0K in the week ended 05 January 2019, signalling a strong labour market. In the prior week, initial jobless claims had registered a revised level of 233.0K, while market participants had expected initial claims to fall to a level of 226.0K.

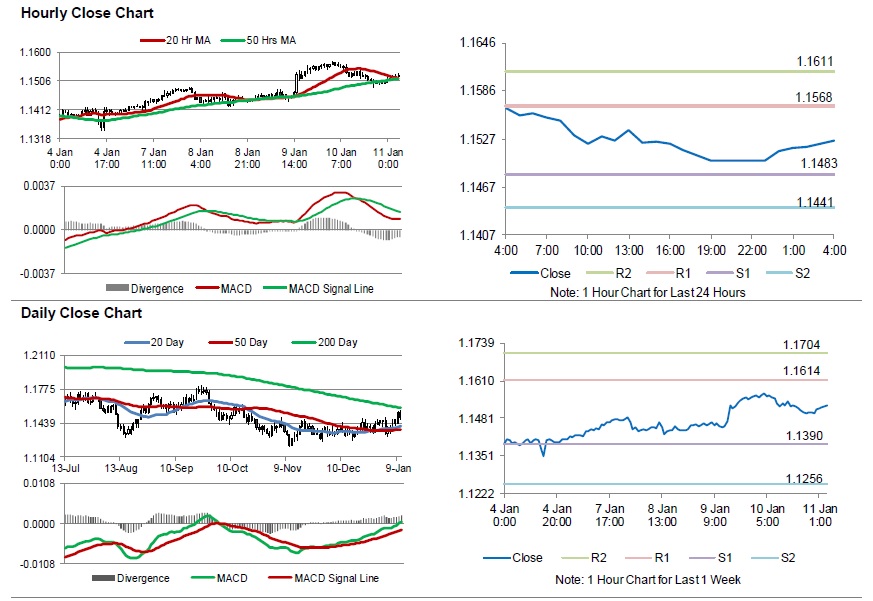

In the Asian session, at GMT0400, the pair is trading at 1.1524, with the EUR trading 0.22% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1483, and a fall through could take it to the next support level of 1.1441. The pair is expected to find its first resistance at 1.1568, and a rise through could take it to the next resistance level of 1.1611.

In absence of key economic releases in the Euro-zone today, investors would closely monitor the US trade balance data for November followed by the consumer price index, average hourly earnings and monthly budget statement, all for December, set to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.