For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1221.

In the US, data indicated that the NY Empire State manufacturing index dropped to a 3-year low level of -8.6 in June, compared to a reading of 17.8 in the prior month. Market participants had envisaged the index to record a fall to a level of 11.0. Moreover, the NAHB housing market index unexpectedly fell to a level of 64.0 in June, declining for the first time in 6 months, amid worries over escalating construction costs. The index had registered a reading of 66.0 in the prior month, while markets had expected for a gain to a level of 67.0.

In the Asian session, at GMT0300, the pair is trading at 1.1232, with the EUR trading 0.10% higher against the USD from yesterday’s close.

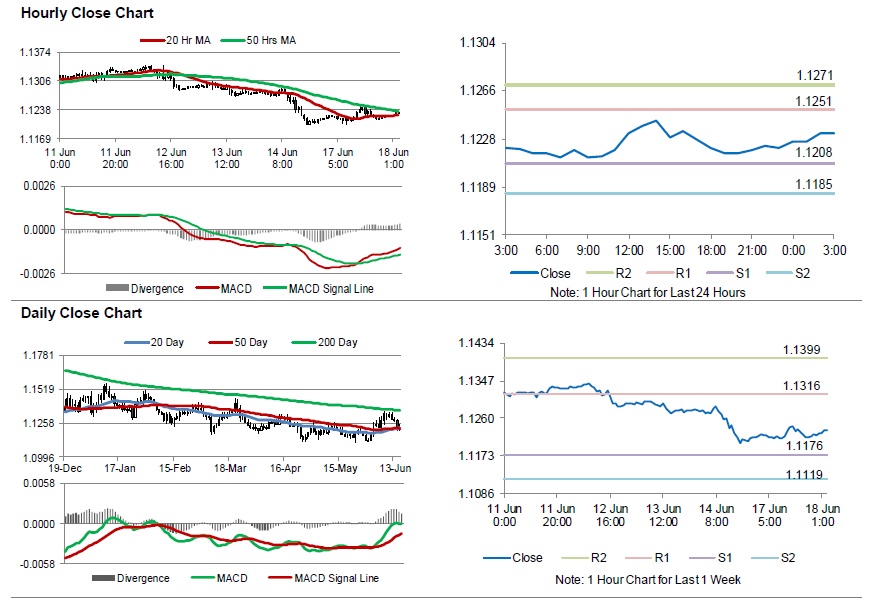

The pair is expected to find support at 1.1208, and a fall through could take it to the next support level of 1.1185. The pair is expected to find its first resistance at 1.1251, and a rise through could take it to the next resistance level of 1.1271.

Looking ahead, traders would await Euro-zone’s trade balance data for April, consumer price index for May along with Germany’s ZEW survey indices for June, set to release in a few hours. Later in the day, the US housing starts and building permits, both for May, will garner significant amount of investor attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.