For the 24 hours to 23:00 GMT, the EUR declined 1.20% against the USD and closed at 91.85.

On the macro front, French non-farm payrolls rose 0.1% on a quarterly basis in 2Q 2014, compared to a drop of 0.1% in the previous quarter. Market expectations were for it to rise 0.1%.

Additionally, industrial production in France unexpectedly climbed 0.2% in July, on a monthly basis, more than market expectations for a drop of 0.5%, following a 1.2% gain in the previous month. Meanwhile, the calendar adjusted industrial production in Spain rose 0.8% in July, after a rise of 0.7% in June.

Separately, the ECB executive board member, Yves Mersch, stated that the central bank’s recent decision to purchase private-sector debt instruments should not be considered as an opening regarding purchases of government bonds and further indicating his opposition for the ECB to follow other major central banks with large-scale public debt purchases.

In the US, the number of mortgage applications registered a drop of 7.2% on a weekly basis, in the week ended 05 September 2014, following a 0.2% rise in the prior week. Meanwhile, wholesale inventories in the US recorded a rise of 0.1%, on a monthly basis lower than market expectations for a rise of 0.5%.

In the Asian session, at GMT0300, the pair is trading at 91.87, with the EUR trading tad higher from yesterday’s close.

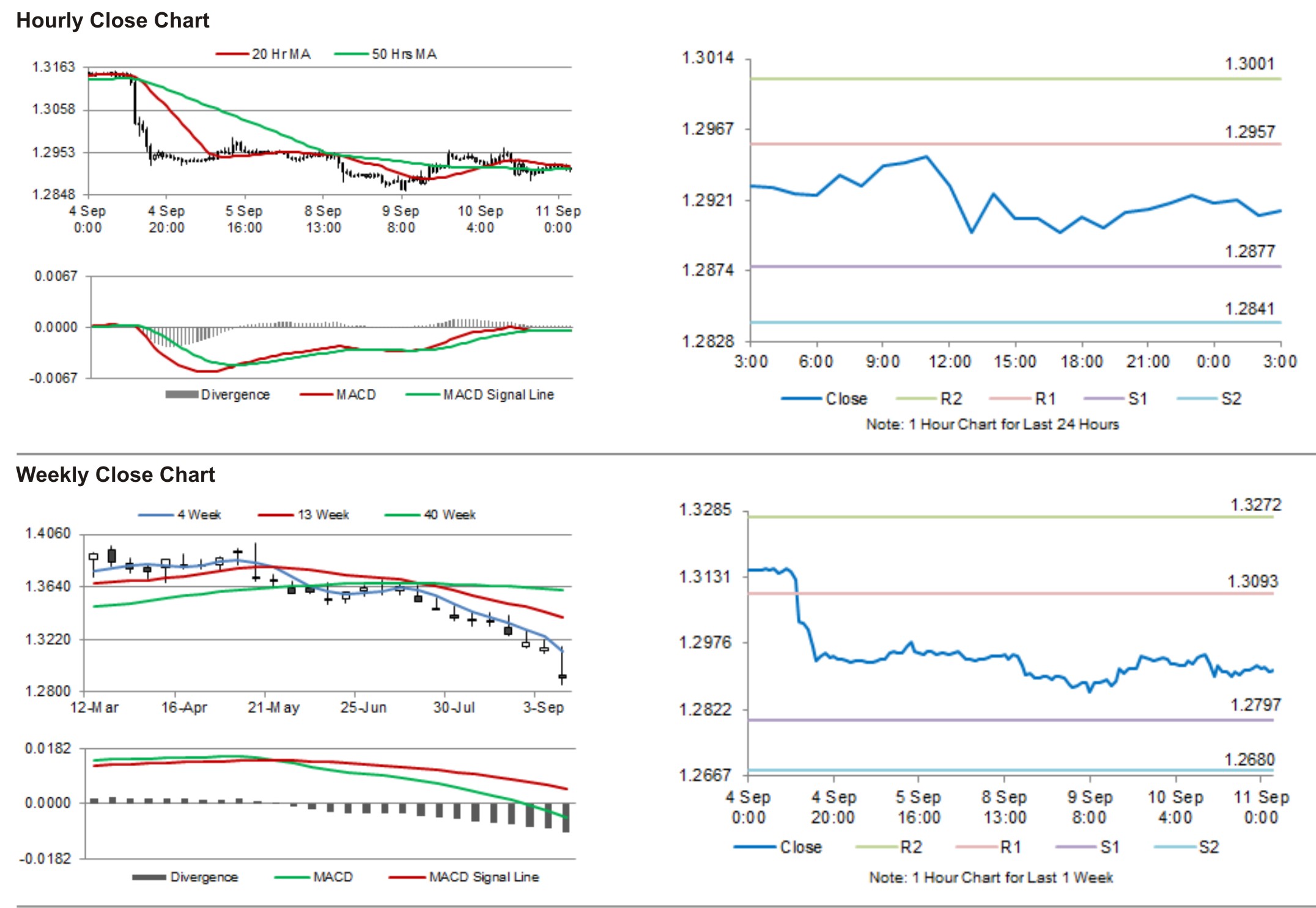

The pair is expected to find support at 91.0533, and a fall through could take it to the next support level of 90.2367. The pair is expected to find its first resistance at 92.8533, and a rise through could take it to the next resistance level of 93.8367.

Trading trends in the Euro today are expected to be determined by Germany’s CPI data as well as the ECB’s monthly report, set for release in a few hours. Meanwhile, investors would also keenly wait for the initial jobless claims data from the US, also scheduled to release ahead in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.