For the 24 hours to 23:00 GMT, the EUR declined 0.44% against the USD and closed at 1.1556.

Losses were kept in check after Germany’s economic sentiment index rose to an11-month high reading of 48.4 in January, compared to a reading of 34.9 registered in the prior month. Market expectations were for the index to rise to a level of 40.0, while the nation’s ZEW current situation index advanced to 22.4 in January, compared to market expectations of an advance to 13.0, thereby easing concerns over the Euro-zone’s biggest economy.

In other economic news, the Euro-zone’s ZEW economic sentiment index edged up to 6-month high level of 45.2 in January, following a reading of 31.8 registered in the prior month.

In the US, the NAHB housing market index registered an unexpected drop to 57.0 in January, compared to a revised reading of 58.0 in the prior month. Markets were anticipating the index to remain unchanged.

Separately, the Fed Governor, Jerome Powell condemned the manipulation of benchmark interest rates like the London Interbank Offered Rate (LIBOR) and called for further supervisory or regulatory actions to prevent such rigging and restore public confidence in the financial system.

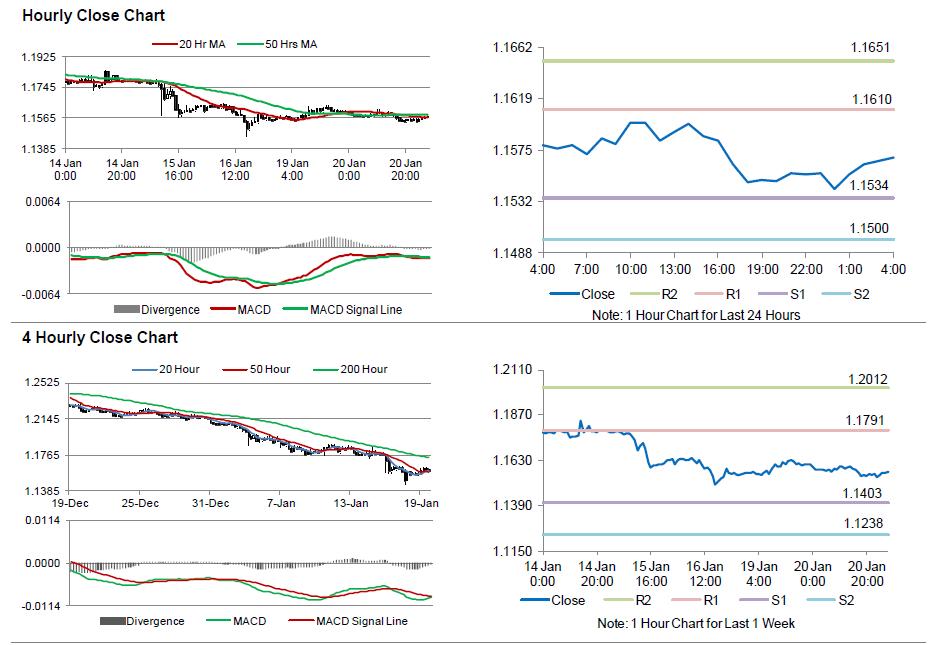

In the Asian session, at GMT0400, the pair is trading at 1.1569, with the EUR trading 0.11% higher from yesterday’s close.

The pair is expected to find support at 1.1534, and a fall through could take it to the next support level of 1.1500. The pair is expected to find its first resistance at 1.1610, and a rise through could take it to the next resistance level of 1.1651.

Trading trends in the Euro today are expected to be determined by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.