For the 24 hours to 23:00 GMT, the EUR declined 0.06% against the USD and closed at 1.1177, following the release of mixed macroeconomic data in Germany.

Data released indicated that the German IFO business climate index advanced to a four-month high of 108.5 in September, beating market expectations of a drop to 107.9, from prior month’s revised reading of 108.4. Additionally, the economic expectation index improved to a level of 103.3 in September, compared to July’s reading of 102.2. However, the nation’s current assessment index fell more than expected to 114.0 in September. It followed a reading of 114.8 recorded in the preceding month. Meanwhile, Germany’s GfK consumer confidence index weakened more than anticipated to a level of 9.6 in October, from 9.9 in the month of September.

The greenback gained ground, after the Fed Chairperson, Janet Yellen, gave clear signals that the US central bank would tighten current monetary policy for the first time before the end of the year, since the 2008 financial crisis. The Fed Chair further added that she expects the US inflation to gradually move up to the Fed’s 2% inflation target.

Economic data released showed that US durable goods orders data slid less than expected by 2.0% in August, registering its first drop in three months and compared to prior month’s downwardly revised gain of 1.9%. Meanwhile, the number of Americans filing for unemployment benefits for the first time rose slower than expected to 267,000 in the week ended 19 September, compared to prior month’s reading of 264,000, indicating that the nation’s labour market is steadily adding jobs.

Other economic data revealed that new home sales climbed more than market forecast of a rise of 5.7% MoM in August, following an increase of 5.4% in July.

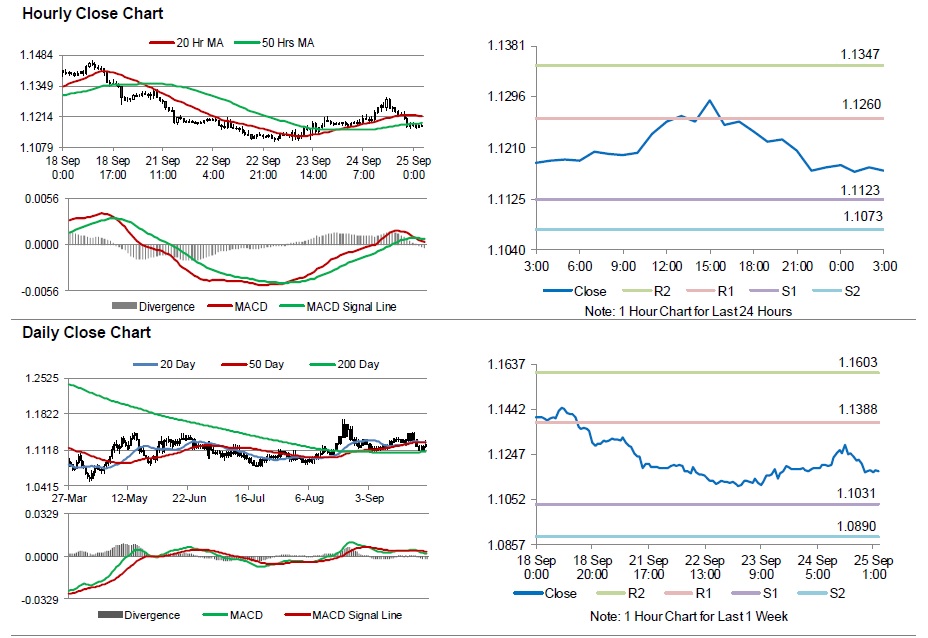

In the Asian session, at GMT0300, the pair is trading at 1.1173, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1123, and a fall through could take it to the next support level of 1.1073. The pair is expected to find its first resistance at 1.1260, and a rise through could take it to the next resistance level of 1.1347.

Trading trends in the pair today are expected to be determined by the US Q2 GDP data, scheduled later today.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.