For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.1329.

In economic news, Euro-zone’s adjusted construction output fell 0.2% MoM in August, compared to an upwardly revised rise of 0.4% in the previous month.

Yesterday, two members of the ECB’s governing council, Ewald Nowotny and Christian Noyer, voiced their opposition towards an imminent extension of the central bank’s €60 billion-a-month bond-buying program in the region.

The greenback gained ground after the US NABH housing market index rose three points to a level of 64 in October, reaching its highest reading in 10 years and beating investor expectations for a reading of 62. The index stood at 61 points last month.

Separately, the San Francisco Fed President, John Williams, stated that inflation in the US was likely to stabilize and expects growth to remain on track, thus enabling policy makers to raise interest rates in the “near future”.

In the Asian session, at GMT0300, the pair is trading at 1.1336, with the EUR trading marginally higher from yesterday’s close.

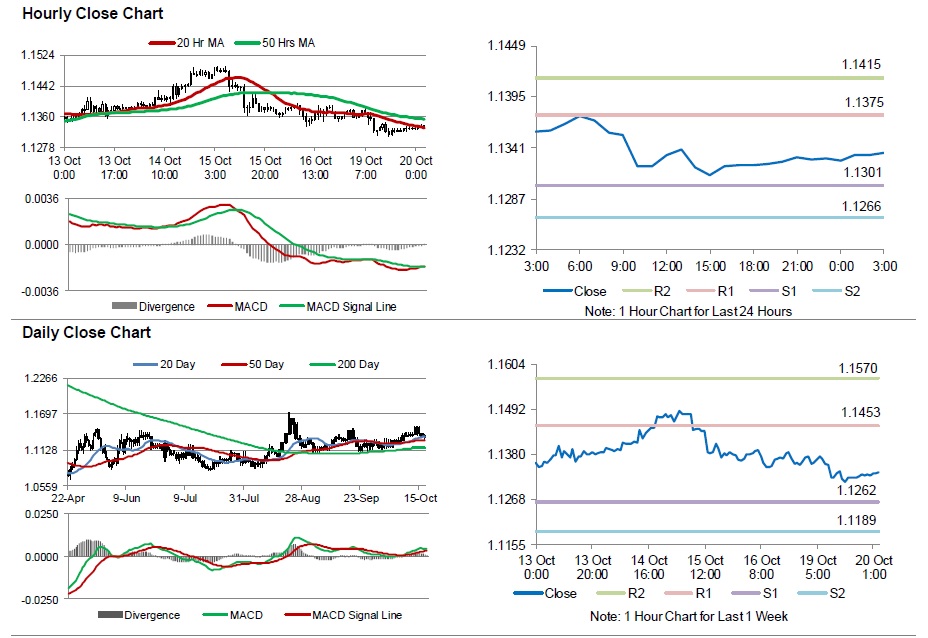

The pair is expected to find support at 1.1301, and a fall through could take it to the next support level of 1.1266. The pair is expected to find its first resistance at 1.1375, and a rise through could take it to the next resistance level of 1.1415.

Moving ahead, market participants will look forward to Germany’s producer price inflation data for September, scheduled to be released in a few hours. Furthermore, the US housing starts and building permits data, both for the month of September, scheduled to be released later in the day, will also attract a significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.