For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.1356.

Macroeconomic data released showed that Euro-zone’s consumer price inflation rose 0.2% MoM in September, as expected, compared to a flat reading in the previous month. However, the seasonally adjusted trade surplus in the Eurozone narrowed to €19.8 billion in August, from €22.4 billion in July.

The greenback gained ground after the preliminary Reuters/Michigan consumer sentiment index rebounded strongly to register a reading of 92.1 in October, its first advance in four months, from a level of 87.2 in September. Investors had expected a reading of 89.0. On the other hand, the US industrial production contracted 0.2% MoM in September, falling for the second straight month, after a 0.1% decline in August. The fall was attributed to lower domestic and overseas demand.

In the Asian session, at GMT0300, the pair is trading at 1.1358, with the EUR trading marginally higher from Friday’s close.

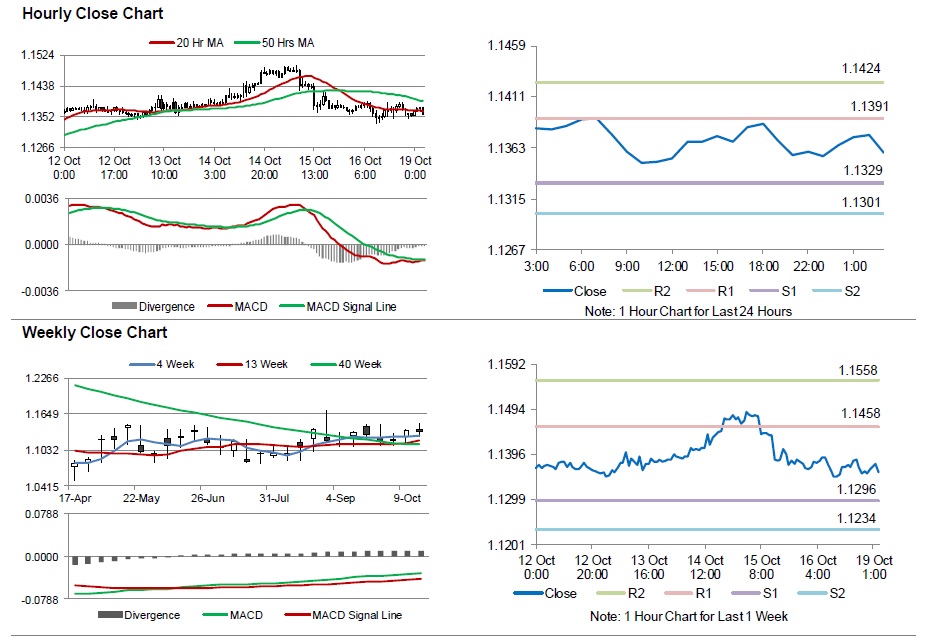

The pair is expected to find support at 1.1329, and a fall through could take it to the next support level of 1.1301. The pair is expected to find its first resistance at 1.1391, and a rise through could take it to the next resistance level of 1.1424.

Going ahead, market participants will look forward to Euro-zone’s construction output data for August, scheduled to be released in a few hours. In addition to this, the US NAHB housing market index data for October, scheduled to be released later in the day, will also garner investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.