For the 24 hours to 23:00 GMT, EUR rose 0.49% against the USD and closed at 1.3751, supported by hopes that Europe would act decisively to manage their sovereign debt crisis. Euro received support, after French President, Nicolas Sarkozy and German Chancellor, Angela Merkel stated that Greece would stay in the euro zone.

Earlier, Euro came under pressure following the reports that rating agency, Moody’s, has downgraded French banks. Moody’s lowered the long-term debt rating of Societe Generale and Credit Agricole, citing funding and liquidity problems for Societe Generale and Greek exposure for Credit Agricole.

In the economic news, the industrial output in the Euro-zone increased 1.0% (M-o-M) in July, reversing a 0.8% decline posted in the previous month.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3738, slightly lower against USD, from the levels yesterday at 23:00GMT.

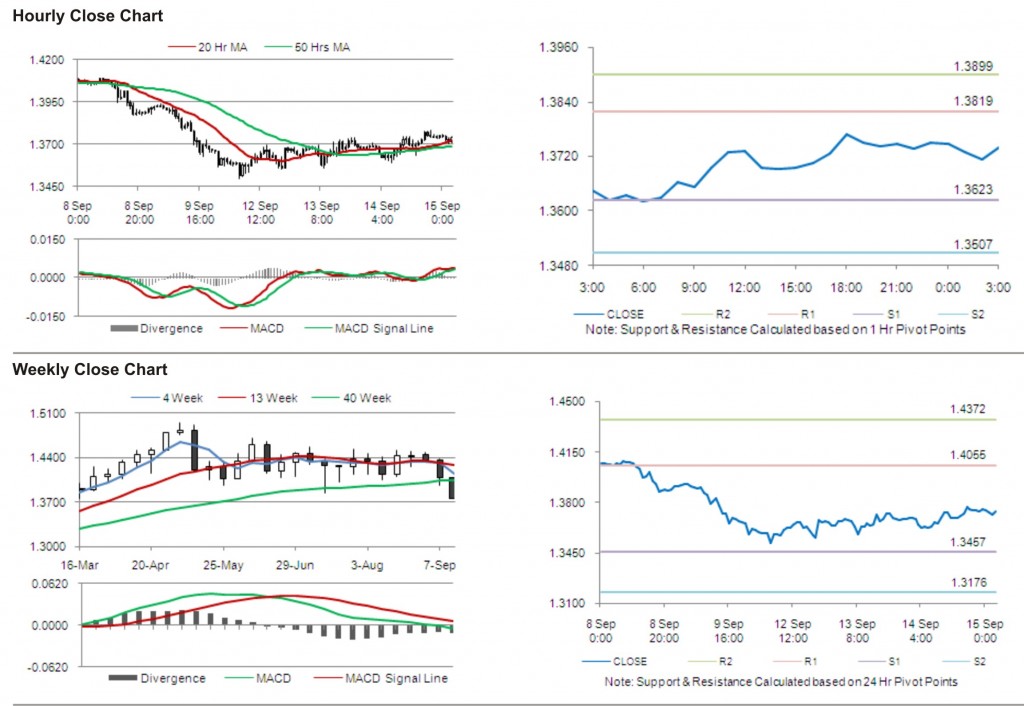

The pair has its first short term resistance at 1.3819, followed by the next resistance at 1.3899. The first support is at 1.3623, with the subsequent support at 1.3507.

Investors are eying the European Central Bank monthly report along with other economic data to be released in the Euro zone later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.