For the 24 hours to 23:00 GMT, EUR rose 0.97% against the USD and closed at 1.3015, amid optimism over a possible deal between Greece and its creditors.

Further, Euro rose after Germany raised €2.54 billion through the issue of 12-month Bubills, with the yield dipping sharply to 0.07%. Also France, saw strong demand at its debt auction and sold a total of €8.202 billion of 13-, 24-, and 50-week Treasury bills.

Meanwhile, in its monthly report for January, the Bundesbank stated that the German economy is likely log a near zero percent growth in the first quarter of 2012, and added that the economic growth is likely to have come to a standstill in the fourth quarter.

On the economic front, the Euro-zone Consumer Confidence Index advanced to -20.6 in January, while the French Industrial Confidence Index in the manufacturing sector fell to 91.0 in January, marking the lowest level since February 2010.

In the Asian session, at GMT0400, the pair is trading at 1.2995, with the EUR trading 0.16% lower from yesterday’s close, after Euro-zone Finance Ministers rejected an offer by private creditors to restructure Greek debt, raising concerns that Greece may default on its debts.

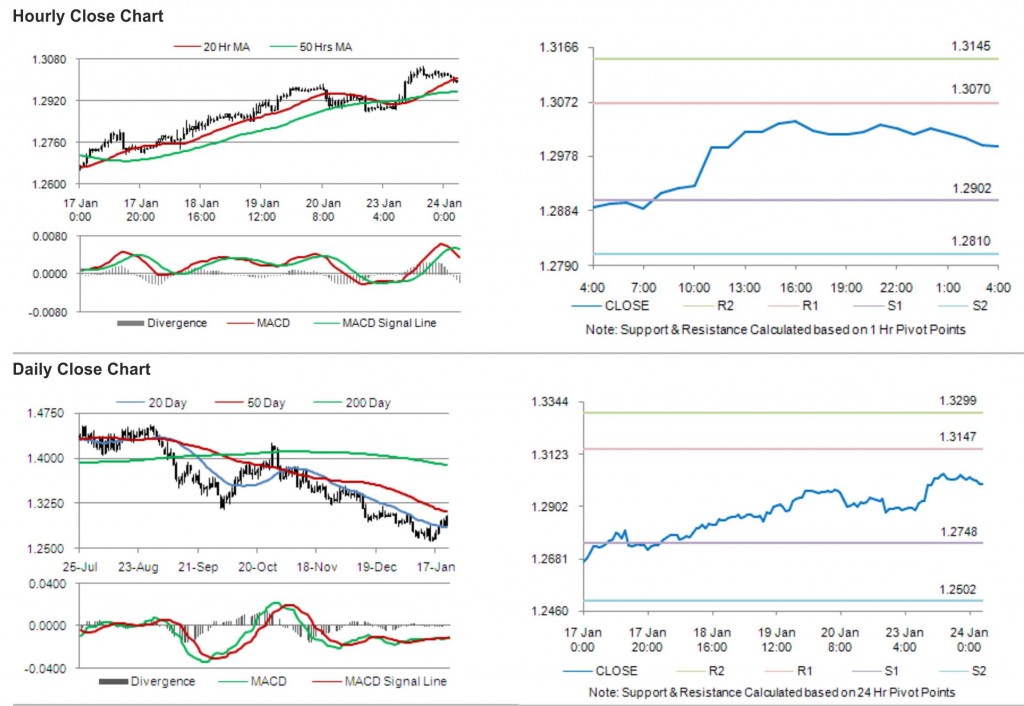

The pair is expected to find support at 1.2902, and a fall through could take it to the next support level of 1.2810. The pair is expected to find its first resistance at 1.3070, and a rise through could take it to the next resistance level of 1.3145.

Trading trends in the pair today are expected to be determined by Purchasing Manager Index and industrial new orders in Euro-zone in later today.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.