For the 24 hours to 23:00 GMT, EUR rose 0.79% against the USD, on Friday, and closed at 1.3211, amid hopes that Greece and its private-sector creditors would reach an agreement.

On Friday, Fitch downgraded the sovereign credit ratings of five European countries, stating that they were vulnerable to monetary and financial shocks in the short run. Fitch downgraded Spain’s long-term Issuer Default Rating to ‘A’ from ‘AA-’, Italy’s to ‘A-’from ‘A+’, Belgium’s to ‘AA’ from ‘AA+’, Cyprus’ to ‘BBB-’ from ‘BBB’ and Slovenia’s to ‘A’ from ‘AA-’.

In economic news, the Import Price Index in Germany rose 3.9% (YoY) in December, compared to a 6.0% increase recorded in November. Additionally, on an annual basis, the M3 money supply growth in the Euro-zone decreased to 1.6% in December from 2.0% in November.

In the Asian session, at GMT0400, the pair is trading at 1.3181, with the EUR trading 0.22% lower from Friday’s close.

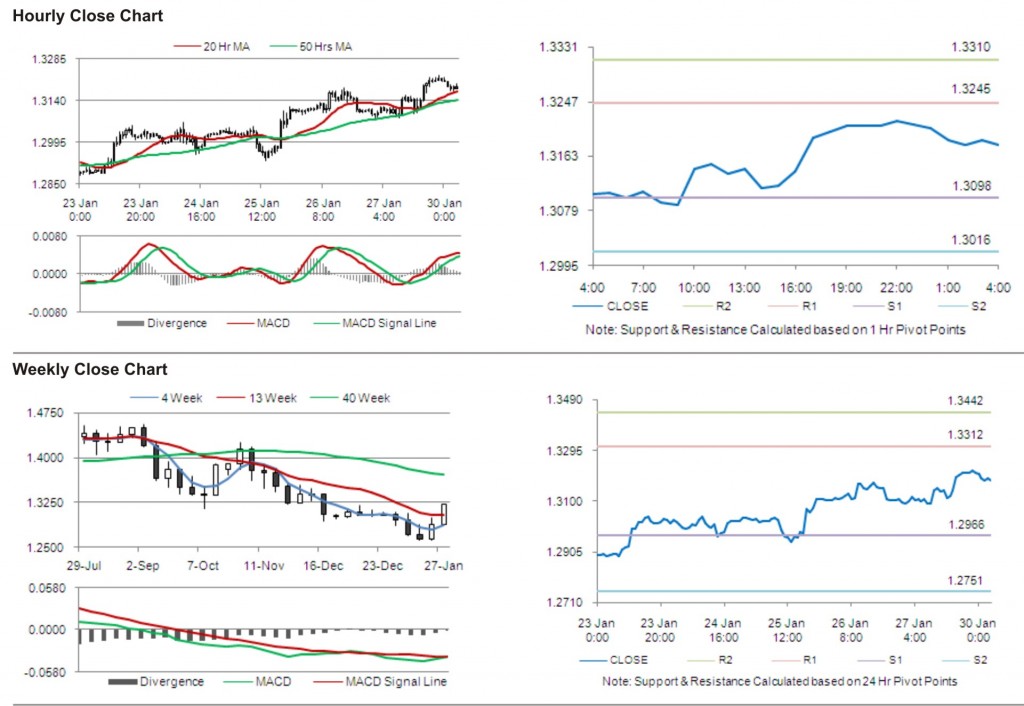

The pair is expected to find support at 1.3098, and a fall through could take it to the next support level of 1.3016. The pair is expected to find its first resistance at 1.3245, and a rise through could take it to the next resistance level of 1.3310.

Euro-zone economic summit is likely to receive increased market attention, along with other economic data in Euro-zone due to be released later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.