For the 24 hours to 23:00 GMT, EUR declined 0.67% against the USD, on Friday, and closed at 1.4177, ahead of Greece votes on budget cuts this week.

The Greek Parliament would vote on Tuesday on a 5-year austerity plan approved by the European Union, European Central Bank, and International Monetary Fund

Moody’s ratings agency has put the ratings of 16 Italian banks on review for possible downgrade and changed the outlook for a further 13 banks to ‘Negative’ from ‘Stable’. The move sparked fresh concerns over European debt problems and weighed on Euro, amid concerns of contagion from the Greek crisis.

In the economic news in Germany, the business climate index rose to 114.5 in June compared to a reading of 114.2 in the previous month. Additionally, the current assessment index increased to 123.3 in June from a reading of 121.5 in the previous month.

In the Asian session, at 3:00 GMT, the EURUSD is trading at 1.4129, 0.34% lower from the levels on Friday at 23:00GMT, with Italy’s debt under the spotlight as continued worries over Greece shook confidence in the euro-zone.

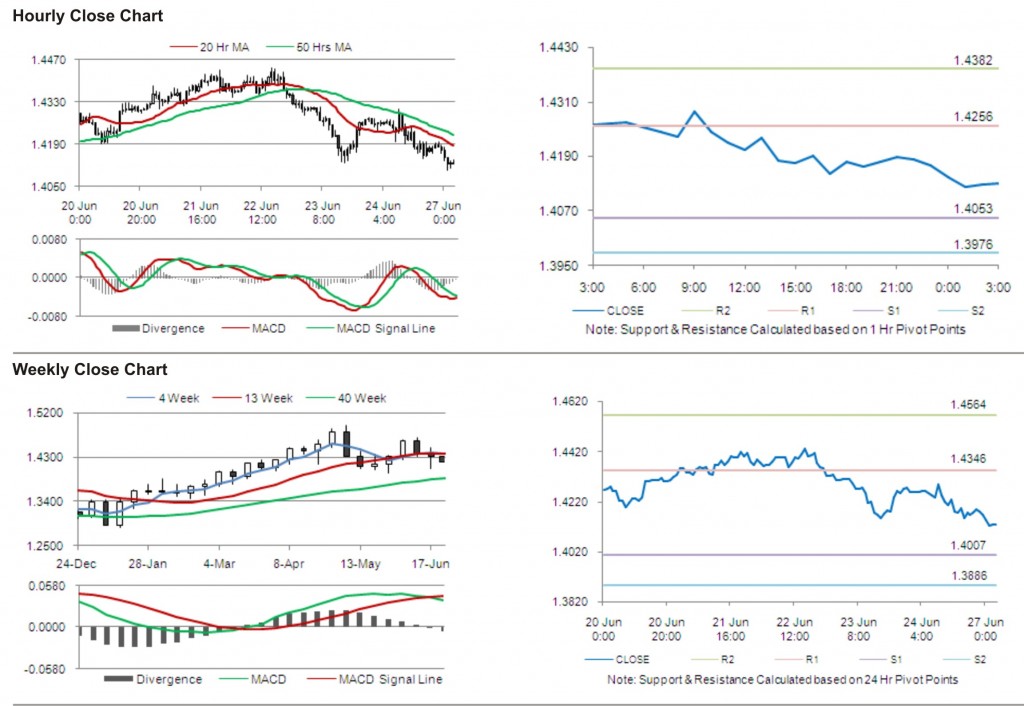

The pair has its first short term resistance at 1.4256, followed by the next resistance at 1.4382. The first support is at 1.4053, with the subsequent support at 1.3976.

Trading trends in the pair today are expected to be determined by data release on retail sales in Germany.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.