For the 24 hours to 23:00 GMT, EUR declined 2.00% against the USD and closed at 1.4066, after the European Central Bank (ECB) President Jean-Claude Trichet stated that he saw downside risks to the regional growth amid growing uncertainties surrounding the credit crisis and the global economy in general.

During his monthly news conference following the central bank’s policy meeting, Trichet stated that downside economic risks may have intensified and that recent data showed that the growth pace in Europe has decelerated.

Trichet also indicated that the ECB has resumed purchases of government bonds amid mounting fears that the eurozone’s sovereign-debt crisis could eventually spread larger economies such as Italy and Spain.

The governing council of the ECB left its main refinance rate unchanged at 1.50%, in-line with market estimates.

In the economic news, on a monthly basis, factory orders in Germany unexpectedly rose 1.8% in June, following a 1.5% rise recorded in May.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4108, 0.30% higher from the levels yesterday at 23:00GMT.

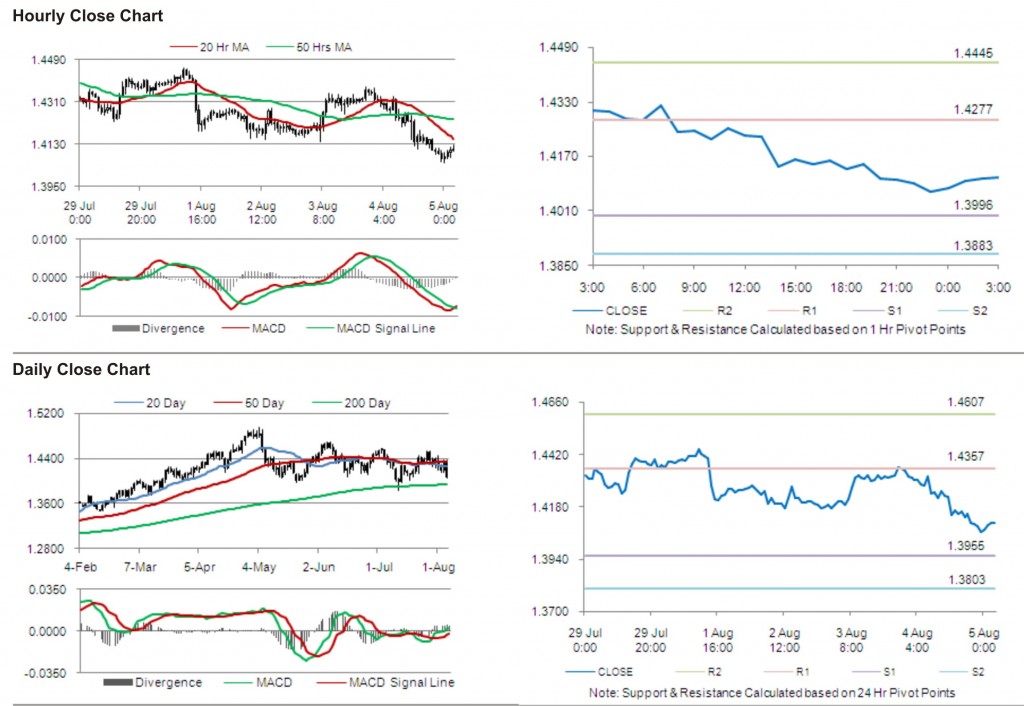

The pair has its first short term resistance at 1.4277, followed by the next resistance at 1.4445. The first support is at 1.3996, with the subsequent support at 1.3883.

Trading trends in the pair today are expected to be determined by data release on industrial production in Germany.

The currency pair is trading just below its 20 Hr moving average and its 50 Hr moving average.