For the 24 hours to 23:00 GMT, the EUR declined 0.53% against the USD and closed at 1.2169, after the German government trimmed Germany’s 2018 growth outlook.

The Euro-zone’s largest economy is expected to grow 2.3% in 2018, down from an earlier estimate of 2.4%, as global trade was unlikely to make a considerable contribution to growth.

On the macro front, French consumer confidence index recorded an unexpected rise to a level of 101.0 in April, while market participants had expected the index to remain steady at a level of 100.0.

The US Dollar advanced against its key counterparts, boosted by easing trade tensions between US and China, following news that the US would likely reach a trade agreement with China.

In economic news, data indicated that the MBA mortgage applications fell 0.2% in the week ended 20 April. In the previous week, mortgage applications had advanced 4.9%.

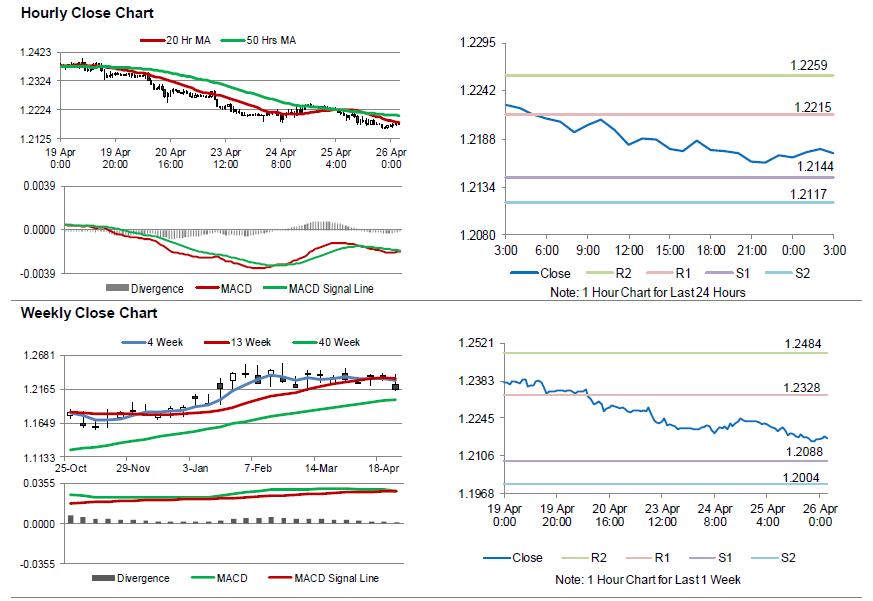

In the Asian session, at GMT0300, the pair is trading at 1.2172, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2144, and a fall through could take it to the next support level of 1.2117. The pair is expected to find its first resistance at 1.2215, and a rise through could take it to the next resistance level of 1.2259.

Trading trend in the Euro today is expected to be determined by the release of the European Central Bank’s (ECB) monetary policy decision, due later in the day. Additionally, the release of German GfK consumer confidence for May, will be eyed by investors. Later in the day, the US initial jobless claims followed by advance goods trade balance and flash durable goods orders data, both for March, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.