For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.1061, after Germany’s final consumer price index advanced 0.1% MoM in June, at par with market expectations and compared to a similar preliminary print.

Macroeconomic data indicated that, the US small business optimism index rose more-than-expected to 94.5 in June, rising for third straight month. The index had registered a level of 93.8 in the prior month while markets expected it to advance slightly to 93.9. Additionally, the nation’s seasonally adjusted wholesale inventories advanced less-than-anticipated by 0.1% MoM in May, compared to market expectations for a gain of 0.2% and following a revised rise of 0.7% in the previous month. On the other hand, the nation’s JOLTs job openings dropped to 5500.0K in May, lower than market expectations of a fall to a level of 5650.0K and after recording a revised reading of 5845.0K in the previous month.

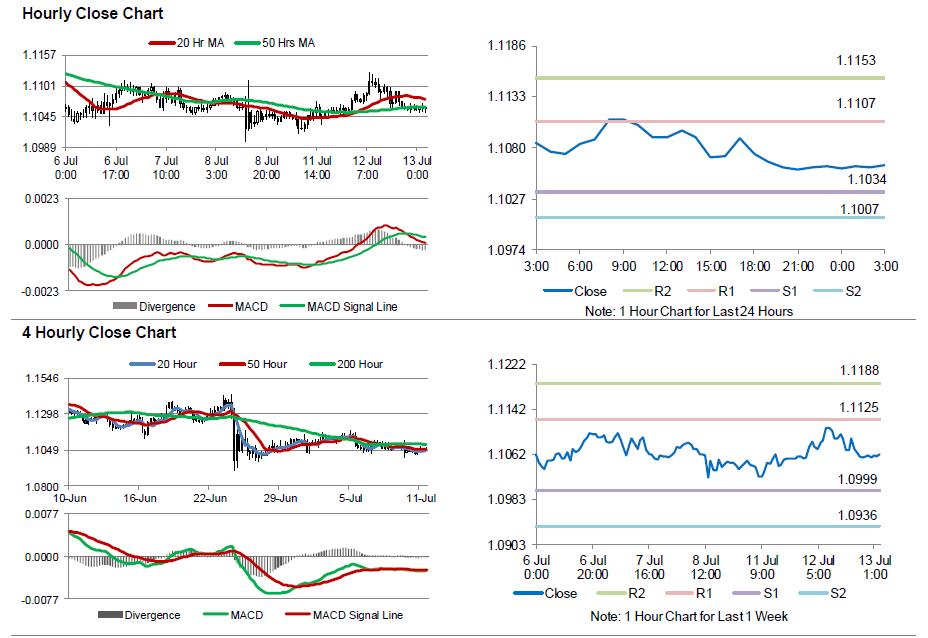

In the Asian session, at GMT0300, the pair is trading at 1.1062, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1034, and a fall through could take it to the next support level of 1.1007. The pair is expected to find its first resistance at 1.1107, and a rise through could take it to the next resistance level of 1.1153.

Moving ahead, investors await the release of Euro-zone’s industrial production data for May, slated to be released in a few hours. Additionally, the US import price index and monthly budget statement, due later in the day, will be on investor’s radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.