For the 24 hours to 23:00 GMT, the EUR declined 0.36% against the USD and closed at 1.1086.

In economic news, Germany’s seasonally adjusted factory orders unexpectedly dropped by 0.4% MoM in June, amid subdued demand for investment goods within the Euro-bloc. Markets expected it to rise by 0.5%, following a revised gain of 0.1% in the prior month.

The US Dollar gained ground, after better than expected non-farm payrolls data cheered investor sentiments.

Macroeconomic data indicated that, non-farm payrolls in the US increased more-than-expected by 255.0K in July, rising for the second straight month, thus pointing to renewed strength in the nation’s labour market and increasing the prospects of a Fed rate hike in the next month. Non-farm payrolls recorded a revised advance of 292.0K in the prior month while markets expected it to advance by 180.0K. Meanwhile, the nation’s unemployment rate remained steady at 4.9% in July, compared to market expectations of a fall to 4.8%. Also, the nation’s consumer credit rose less-than-anticipated by $12.32 billion, compared to a revised rise of $17.91 billion in the prior month and defying market expectations for a rise of $16.0 billion.

In the Asian session, at GMT0300, the pair is trading at 1.1090, with the EUR trading marginally higher against the USD from Friday’s close.

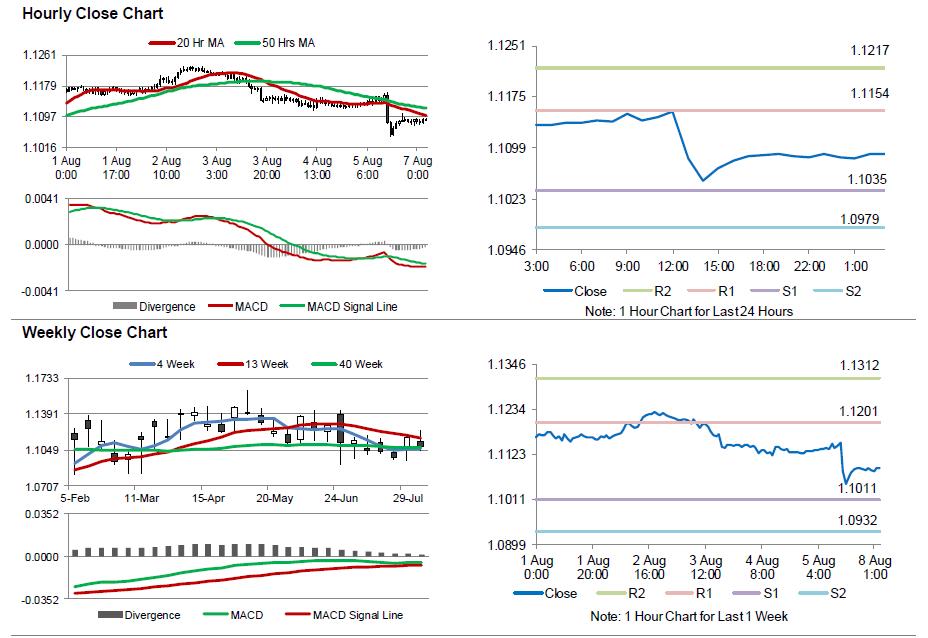

The pair is expected to find support at 1.1035, and a fall through could take it to the next support level of 1.0979. The pair is expected to find its first resistance at 1.1154, and a rise through could take it to the next resistance level of 1.1217.

Moving ahead, investors would now concentrate on Euro-zone’s Sentix investor confidence data for August, due to release in a few hours. Moreover, the US labour market conditions index for July, scheduled to release later today, would also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.