For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.0986.

The US Dollar gained ground, after data indicated sustained growth in the US economy that could encourage the Federal Reserve to raise interest rates this year.

Data showed that the US consumer confidence index fell slightly to a level of 97.3 in July, highlighting that consumer spending could continue to support the economy in the near term, compared to a revised level of 97.4 in the previous month and defying investor expectations for it to fall to a level of 96.0. Additionally, the nation’s new home sales rebounded by 3.5% MoM in June, rising at the fastest pace in more than eight years, indicating a strong and resilient housing market. Markets expected it to climb by 1.6%, compared to a fall of 6.0% in the preceding month. Also, the flash Markit services PMI unexpectedly expanded at a slower pace to a level of 50.9 in July, compared to market expectations of an advance to 52.0 and after registering a level of 51.4 in the prior month. Moreover, the Richmond Fed manufacturing index unexpectedly climbed to 10.0 in July while markets expected it to fall to a level of -5.0. In the prior month, the index had registered a revised reading of -10.0.

In the Asian session, at GMT0300, the pair is trading at 1.0989, with the EUR trading marginally higher against the USD from yesterday’s close.

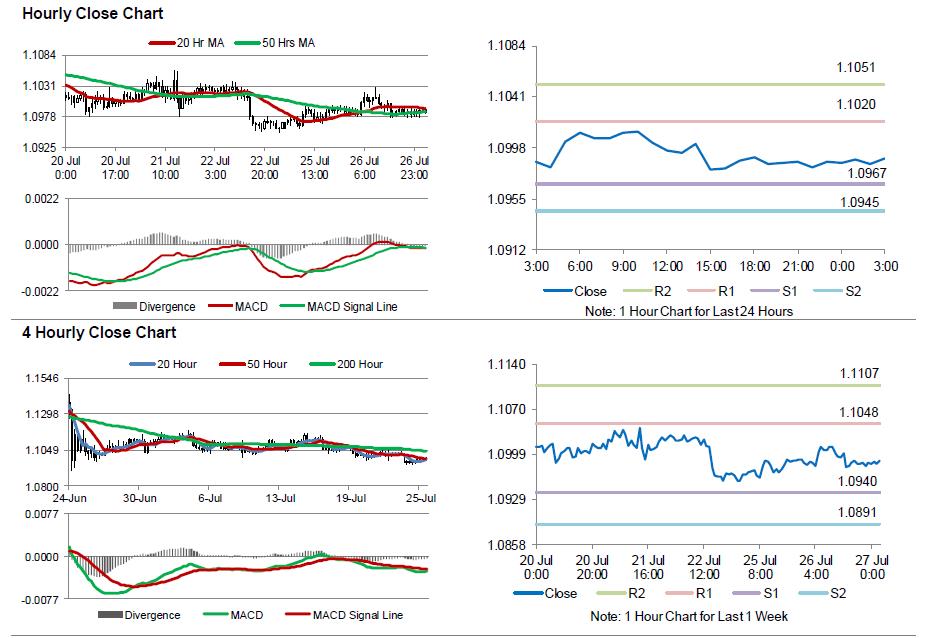

The pair is expected to find support at 1.0967, and a fall through could take it to the next support level of 1.0945. The pair is expected to find its first resistance at 1.1020, and a rise through could take it to the next resistance level of 1.1051.

Going ahead, market participants would closely monitor Germany’s GfK consumer confidence survey data for August, scheduled to be released in a few hours. Moreover, the US Fed interest rate decision along with preliminary US durable goods orders and pending home sales data, slated to release later in the day, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.