For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1900.

On the data front, Italy’s consumer confidence index unexpectedly fell to a level of 114.3 in November, defying market expectations for a rise to a level of 116.5. In the previous month, the index had registered a revised reading of 116.0.

The greenback erased some of its losses against its key peers, on the heels of better-than-expected data on the US housing sector.

Data showed that new home sales in the US surprisingly climbed 6.2% on a monthly basis to a level of 685.0K in October, soaring to its highest level in a decade, amid robust demand across the nation. In the prior month, the new home sales had registered a revised level of 645.0K, while markets had anticipated for a fall to a level of 627.0K. On the other hand, the nation’s Dallas Fed manufacturing business index dropped more-than-expected to a level of 19.4 in November, after recording a reading of 27.6 in the prior month. Market participants had anticipated the index to ease to a level of 24.0.

Meanwhile, Jerome Powell, the US President, Donald Trump’s nominee for the next Federal Reserve (Fed) Chair, stated that he expects the US central bank to continue gradual interest rate hikes in order to achieve dual goals of maximum employment and stable prices.

Additionally, the Dallas Fed President, Robert Kaplan signalled his support for a December interest rate hike, stating that waiting too long to tighten policy could increase the risk of recession.

In the Asian session, at GMT0400, the pair is trading at 1.1905, with the EUR trading marginally higher against the USD from yesterday’s close.

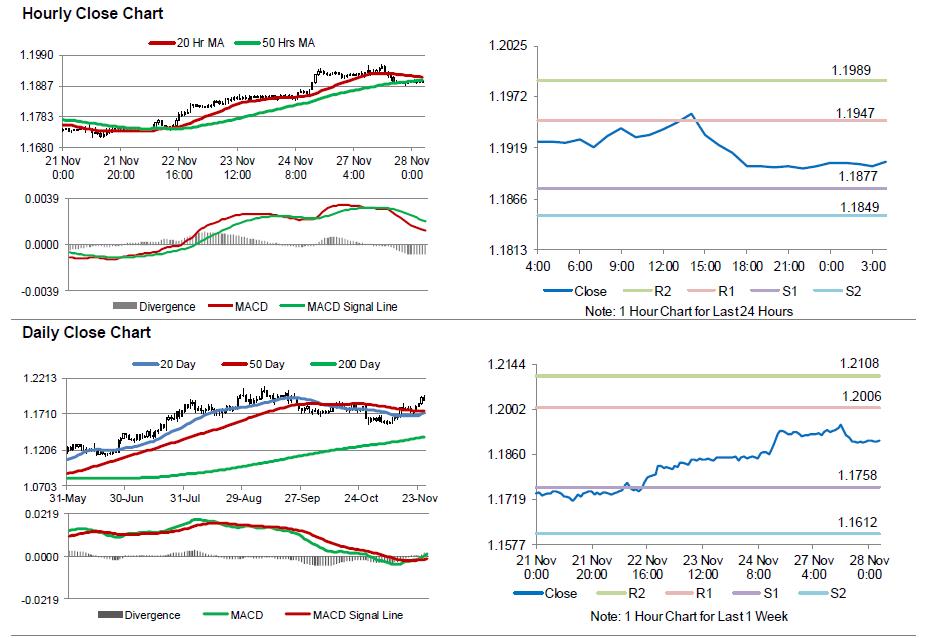

The pair is expected to find support at 1.1877, and a fall through could take it to the next support level of 1.1849. The pair is expected to find its first resistance at 1.1947, and a rise through could take it to the next resistance level of 1.1989.

Moving forward, traders would keep a close watch on Germany’s GfK consumer confidence index for December, slated to release in a few hours. Later in the day, the US advance goods trade balance for October and the CB consumer confidence index for November, will garner significant amount of investor attention. Additionally, the release of OECD economic outlook report, will be on investors’ radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.