For the 24 hours to 23:00 GMT, the EUR rose 0.83% against the USD and closed at 1.1237, following positive IFO economic indicators data in Germany.

Yesterday’s data showed that Germany’s IFO business climate index rose to a 6-month high level of 106.7 in January, compared to market expectations of an advance to 106.3. In the prior month, the index had recorded a reading of 105.5. Additionally, the nation’s IFO current assessment index improved more than expected to a level of 111.7 in January, compared to a revised level of 109.8 in December. However, the nation’s IFO business expectations index recorded a rise to 102.0 in January, lower than market expectations of a rise to a level of 102.5.

In the US, the Dallas Fed manufacturing business index fell to a level of -4.40, compared to market expectations reading of 3.0, following a reading of 4.1 registered in the preceding month.

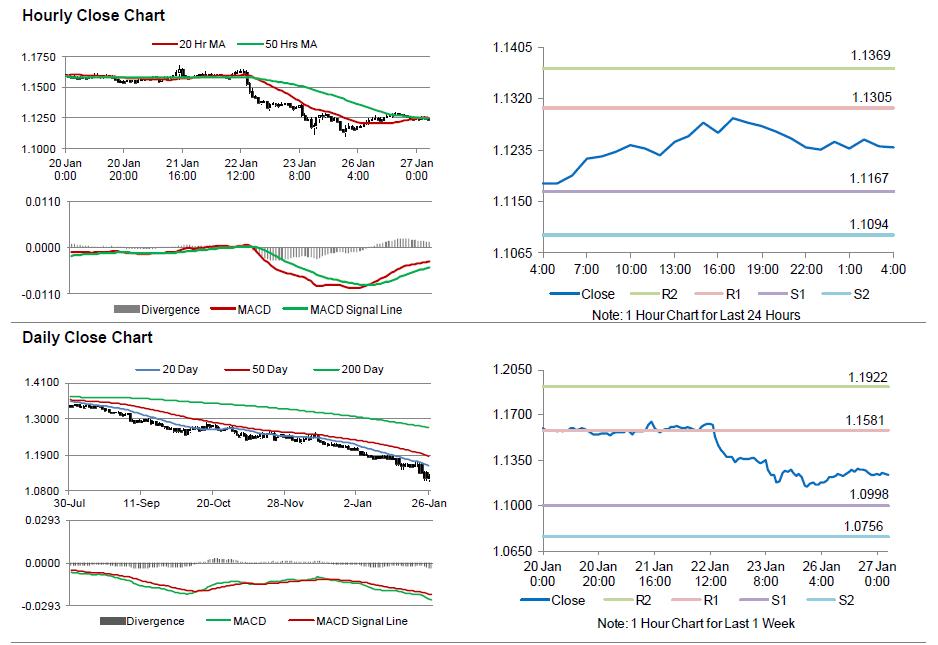

In the Asian session, at GMT0400, the pair is trading at 1.1240, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.1167, and a fall through could take it to the next support level of 1.1094. The pair is expected to find its first resistance at 1.1305, and a rise through could take it to the next resistance level of 1.1369.

Trading trends in the pair today are expected to be determined by the US durable goods orders along with consumer confidence data, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.