For the 24 hours to 23:00 GMT, the EUR declined 0.20% against the USD and closed at 1.1200, after the Euro-zone’s seasonally adjusted construction output declined 0.9%, falling for the second consecutive month and following a 0.6% revised drop in the previous month.

Separately, the European Central Bank’s (ECB) April monetary policy meeting minutes revealed that the central bank policy makers were in no hurry to change the existing monetary policy stance, with focus remaining on how to boost the region’s inflation. The ECB further indicated that the Eurozone’s incoming data pointed to output growth at a moderate pace, but felt that risks to the growth outlook were still to the downside.

In the US, initial jobless claims dropped to a level of 278.0K in the week ended 14 May 2016, higher than market expectations of a fall to a level of 275.0K. Initial jobless claims had registered a reading of 294.0K in the previous week. Additionally, the nation’s Chicago Fed national activity index rose to a level of 0.1, compared to market expectations of an advance to a level of -0.2. The Chicago Fed national activity index had registered a revised level of -0.55 in the prior month. On the other hand, the Philadelphia Fed manufacturing index registered an unexpected drop to a level of -1.8 in May, compared to a reading of -1.6 in the prior month. Markets were expecting Philadelphia Fed manufacturing index to climb to a level of 3.0.

Meanwhile, the New York Federal Reserve President, William Dudley, indicated that the US economy could be strong enough to warrant an interest rate increase in June or July, given that the economy rebounds from a weak first quarter.

In the Asian session, at GMT0300, the pair is trading at 1.1201, with the EUR trading marginally higher from yesterday’s close.

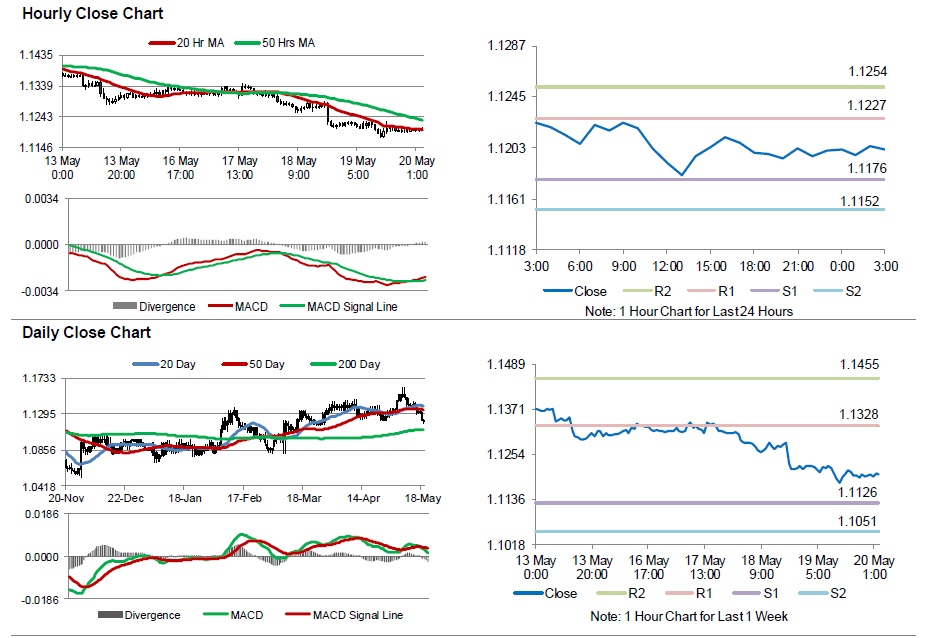

The pair is expected to find support at 1.1176, and a fall through could take it to the next support level of 1.1152. The pair is expected to find its first resistance at 1.1227, and a rise through could take it to the next resistance level of 1.1254.

Going ahead, investors will look forward to Germany’s producer prices data for April, scheduled to release in a few hours. Moreover, the US existing home sales data for April, due later today, will also grab market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.