For the 24 hours to 23:00 GMT, the EUR rose 2.08% against the USD and closed at 1.1156, after the Euro-zone’s consumer price index estimate surprised on the upside on an annual basis in May, following five months of no growth.

Yesterday’s data showed that core consumer prices in the Euro-zone advanced 0.90% YoY in May, higher than market expectations for a rise of 0.70% and compared to a 0.60% rise recorded in the previous month.

In other economic news, Germany’s jobless rate remained flat at a level of 6.40% in May, in line with market expectations. Meanwhile, threat of a Greek default looms large, as an imminent deadline for a payment to the IMF by the Greek government nears.

The greenback came under pressure, as the orders for goods produced in US factories dropped 0.4% on a monthly basis in April, registering the eighth decline in nine months. Analysts had expected orders to dip 0.1% after a revised 2.2% rise in the previous month.

Other economic data showed that IBD/TIPP economic optimism index dropped unexpectedly to 48.10 in June, compared to market expectations of a rise to 49.90.

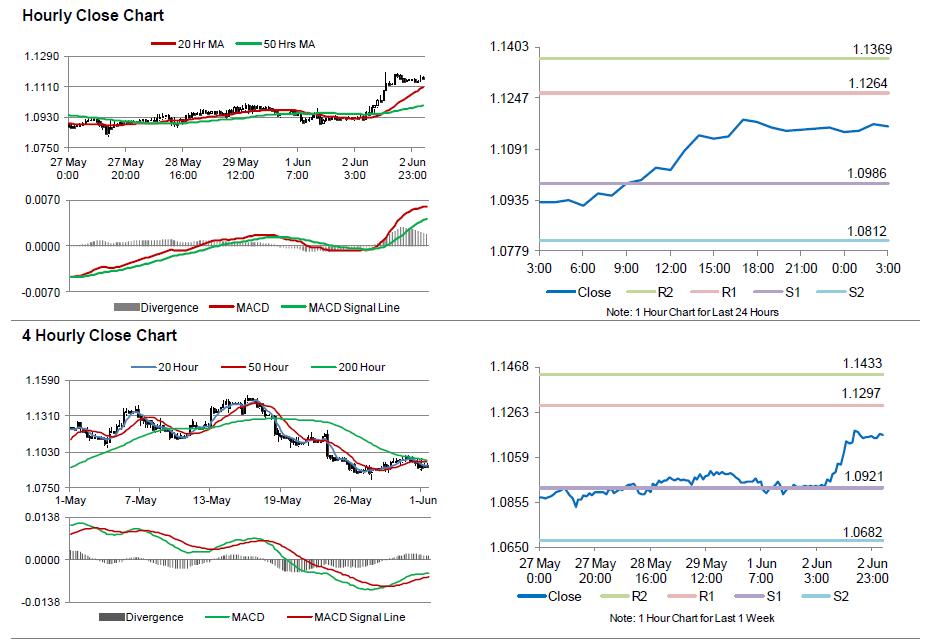

In the Asian session, at GMT0300, the pair is trading at 1.1160, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0986, and a fall through could take it to the next support level of 1.0812. The pair is expected to find its first resistance at 1.1264, and a rise through could take it to the next resistance level of 1.1369.

Going forward, the ECB will hold its monetary policy meeting, scheduled in a few hours. Additionally, investors will continue tracking the development of debt talks with Greece.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.