For the 24 hours to 23:00 GMT, the EUR rose 0.47% against the USD and closed at 1.1260, after the Euro-zone’s seasonally adjusted trade surplus widened to a record high level of €28.0 billion in April, as growth in exports outpaced the increase in imports. The region had recorded a revised trade surplus of €23.7 billion in the prior month.

The greenback lost ground after the US Federal Reserve (Fed) held benchmark interest rate steady, citing weakness in recent employment data. The Fed Chairwoman, Janet Yellen, indicated that the central bank needs a clearer picture of economic developments before raising rates again and stated that it plans to increase rates twice this year. Further, the Fed’s expectations for US GDP growth dropped to 2.0% this year and in 2017, 0.1 percentage point lower than previously forecasted for each year.

In other economic news, US producer price index (PPI) advanced above expectations by 0.4% MoM in May, rising for the second consecutive month, as the cost of energy products and services increased. Market expectation was for PPI to rise 0.3%, following a 0.2% increase in the previous month. Additionally, the NY Empire State manufacturing index registered a rise to a level of 6.0 in June, higher than market expectations. In the prior month, the index had registered a level of -9.02. On the other hand, US industrial production fell more-than-expected by 0.4% in May, led by a decline in utilities output and auto manufacturing, after recording a revised 0.6% increase in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1264, with the EUR trading marginally higher against the USD from yesterday’s close.

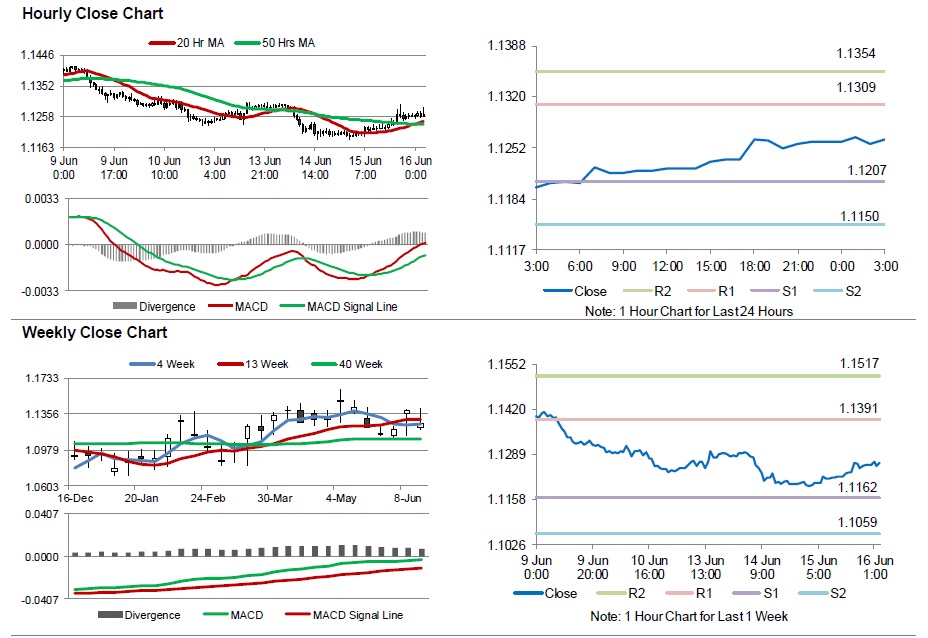

The pair is expected to find support at 1.1207, and a fall through could take it to the next support level of 1.1150. The pair is expected to find its first resistance at 1.1309, and a rise through could take it to the next resistance level of 1.1354.

Going ahead, investors look forward to the Euro zone’s consumer price index (CPI) data for May along with the European Central Bank’s economic bulletin report, scheduled to release in a few hours. Moreover, the US weekly jobless claims and CPI data will attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.