For the 24 hours to 23:00 GMT, the EUR rose 0.84% against the USD and closed at 1.0766.

The greenback lost ground, following downbeat initial jobless claims data in the US. Data showed that number of people filing new claims for unemployment benefits unexpectedly climbed to 294 K in the week ended 11 April, compared to prior week’s level of 282 K, while markets were expecting it to drop to a reading of 280 K. On the other hand, continuing claims in the nation surprisingly fell to 2268 K, its lowest level since December 2000 in the week ended 04 April, compared to market expectations of an advance to 2323.00 K. Continuing jobless claims had registered a revised level of 2308.00 K in the previous week.

Other economic data revealed that building permits dropped 5.70% on a monthly basis, to an annual rate of 1039.00 K in March, lower than market expectations of 1085.00 K and had registered a revised reading of 1102.00 K in the prior month. Meanwhile, housing starts in the US recorded a rise of 2.00% MoM in March, lower than market expected rise of 15.9% and following a revised drop of 15.3% recorded in February. Also, the Philadelphia Fed manufacturing index advanced to 7.50, up from prior month’s reading of 5.00, while markets were anticipating the index to climb to a level of 6.00.

Separately, the Atlanta Fed President, Dennis Lockhart opined that the recent gloomy run of economic data in the US has made him about a June interest rate hike. However, he expressed confidence that the nation’s economy will remain on track.

In the Asian session, at GMT0300, the pair is trading at 1.0769, with the EUR trading marginally higher from yesterday’s close.

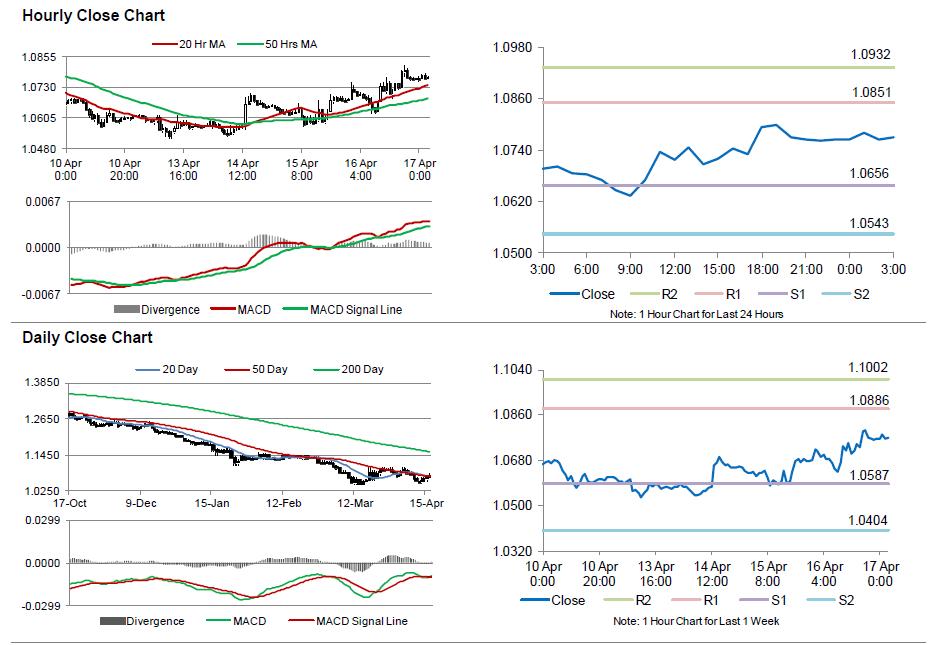

The pair is expected to find support at 1.0656, and a fall through could take it to the next support level of 1.0543. The pair is expected to find its first resistance at 1.0851, and a rise through could take it to the next resistance level of 1.0932.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer prices data, scheduled in a few hours. Meanwhile, the US CPI coupled with the Michigan consumer sentiment indices data, would generate lot of market attention, scheduled later today.

The currency pair is trading above with its 20 Hr and 50 Hr moving averages.