For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.1250.

Yesterday, the European Central Bank (ECB) President Mario Draghi hinted that there could be another delay in rate hikes, if required and expressed concerns over the impact of negative interest rates. Further, he expects rates to remain at their present levels at least through the end of 2019. Meanwhile, Draghi stated that a temporary slowdown in the Eurozone does not necessarily foreshadow a serious recession.

In the US, data showed that the US trade deficit narrowed to $51.1 billion in January, amid rise in export and compared to a revised deficit of $59.9 billion in the previous month. Market participants had envisaged the nation to post a deficit of $57.0 billion. Meanwhile, the MBA mortgage applications surged 8.9% on a weekly basis in the week ended 22 March 2019, following a rise of 1.6% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1253, with the EUR trading marginally higher against the USD from yesterday’s close.

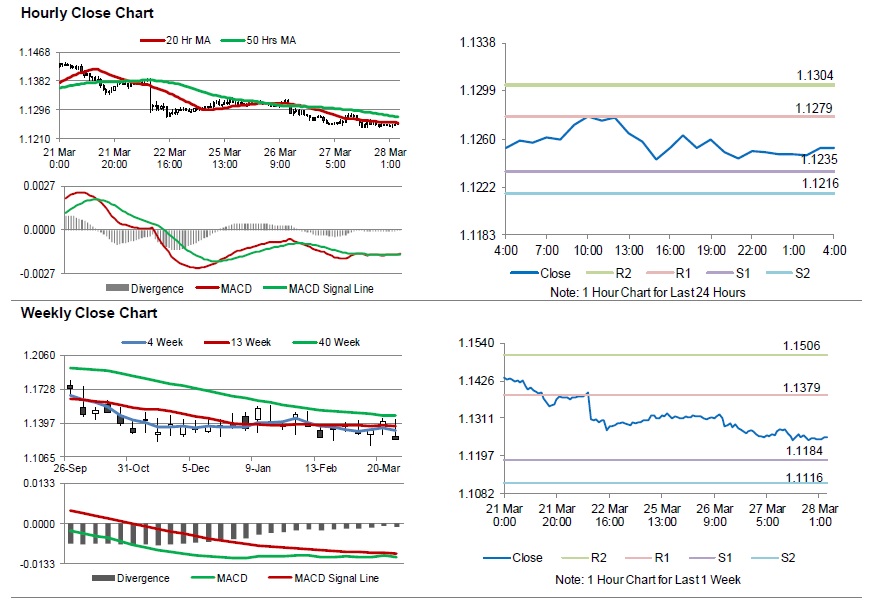

The pair is expected to find support at 1.1235, and a fall through could take it to the next support level of 1.1216. The pair is expected to find its first resistance at 1.1279, and a rise through could take it to the next resistance level of 1.1304.

Looking ahead, traders would closely monitor the Euro-zone’s economic confidence, services confidence, industrial confidence and consumer confidence, all for March, set to release in a few hours. Also, Germany’s consumer price index for March, will garner significant amount of investors’ attention. Later in the day, the US annualised gross domestic product for 4Q and pending home sales for February followed by initial jobless claims, will be on traders’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.