For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.1137.

The US dollar gained ground against a basket of currencies, amid robust US capital goods orders data.

In the US, data indicated that preliminary durable goods orders rebounded 2.7% on a monthly basis in March, hitting a 7-month high level, amid weaker growth of industrial sector. Durable goods orders had registered a drop of 1.6% in the previous month, while market participants had expected for a rise of 0.8%. Meanwhile, the nation’s seasonally adjusted initial jobless claims advanced to a level of 230.0K in the week ended 20 April 2019, rising by the most in 19-months and compared to market expectations of a gain to a level of 200.0K. In the previous week, initial jobless claims had registered a revised reading of 193.0K.

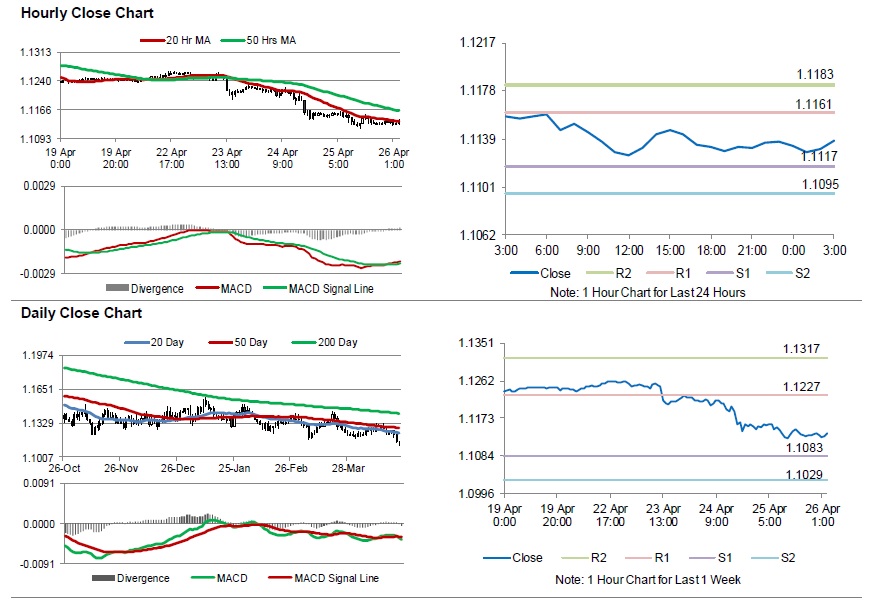

In the Asian session, at GMT0300, the pair is trading at 1.1138, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1117, and a fall through could take it to the next support level of 1.1095. The pair is expected to find its first resistance at 1.1161, and a rise through could take it to the next resistance level of 1.1183.

Amid lack of economic releases in Canada today, traders would focus on the US gross domestic product annualised and personal consumption, both for the first quarter of 2019, along with the Michigan consumer sentiment index for April, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.