For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1167 on Friday.

In the US, data showed that non-farm payrolls increased by 128.0K in October, beating market expectations for an advance of 89.0K. Non-farm payrolls had recorded a revised gain of 180.0K in the prior month. Moreover, the average hourly earnings of all employees rose 3.0% on an annual basis in October, meeting market expectations. In the previous month, average hourly earnings of all employees had registered a similar revised rise. Further, the construction spending climbed 0.5% on a monthly basis in September, more than market expectations for an increase of 0.2%. In the prior month, construction spending had recorded a revised fall of 0.3%. Meanwhile, the US final Markit manufacturing PMI advanced to a level of 51.3 in October, less than market expectations and preliminary consensus for a rise to a level of 51.5. In the prior month, the PMI had registered a reading of 51.1. Also, the nation’s ISM manufacturing activity index climbed to a level of 48.3 in October, less than markets anticipations for a rise to a level of 48.9. In the prior month, the index had recorded a reading of 47.8. Moreover, the unemployment rate climbed to 3.6% in October, at par with market consensus. In the preceding month, unemployment rate stood at 3.5%.

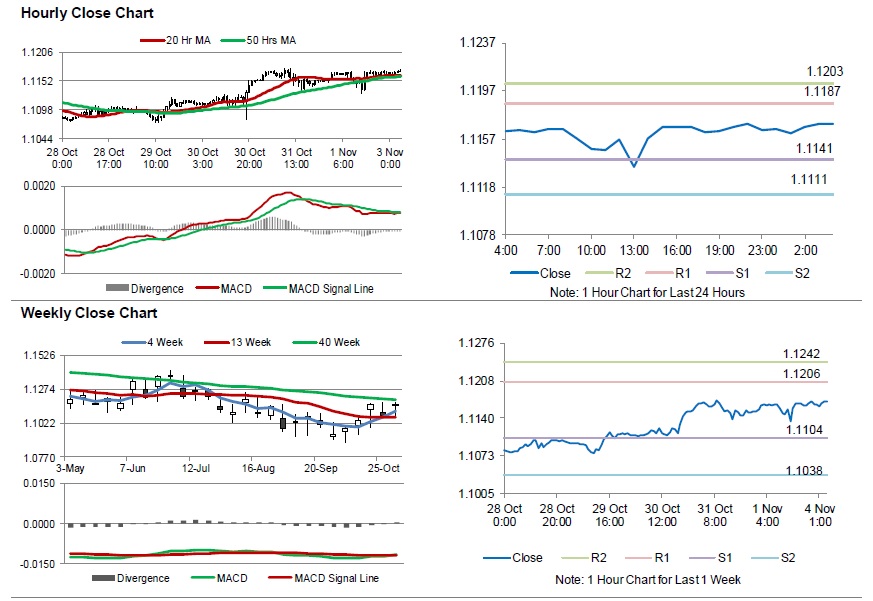

In the Asian session, at GMT0400, the pair is trading at 1.1170, with the EUR trading slightly higher against the USD from Friday’s close.

The pair is expected to find support at 1.1141, and a fall through could take it to the next support level of 1.1111. The pair is expected to find its first resistance at 1.1187, and a rise through could take it to the next resistance level of 1.1203.

Moving ahead, traders would await Euro-zone’s Sentix investor confidence for November along with the Markit manufacturing PMIs for October, set to release across the euro bloc. Later in the day, the US factory orders for September, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.