For the 24 hours to 23:00 GMT, the EUR rose slightly against the USD and closed at 1.1646.

The US dollar declined against the Euro, after the US President, Donald Trump criticised the Federal Reserve’s (Fed) policy of gradual rate hike.

In the US, data indicated that the Philadelphia Fed manufacturing index climbed to 25.7 in July, higher than market expectations for a rise to 21.5. In the previous month, the index had registered a reading of 19.9. Meanwhile, the nation’s leading indicator advanced 0.5% on a monthly basis in June, while market participants had envisaged for a rise of 0.4%. Leading indicator had recorded a revised flat reading in the previous month.

Other data showed that the nation’s seasonally adjusted initial jobless claims unexpectedly dropped to a 48-year low level of 207.0K in the week ended 14 July 2018, defying market expectations for an increase to a level of 220.0K. Initial jobless claims had registered a revised level of 215.0 K in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1649, with the EUR trading marginally higher against the USD from yesterday’s close.

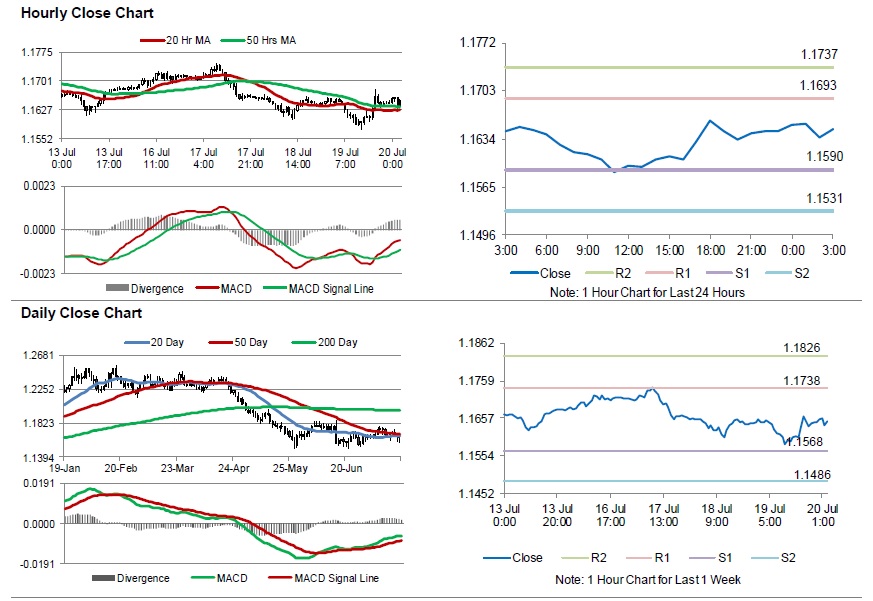

The pair is expected to find support at 1.1590, and a fall through could take it to the next support level of 1.1531. The pair is expected to find its first resistance at 1.1693, and a rise through could take it to the next resistance level of 1.1737.

Going forward, investors will await Germany’s producer price index for June, set to release in a while.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.