For the 24 hours to 23:00 GMT, the EUR declined 1.13% against the USD and closed at 1.0664, as investors shrugged off Germany’s positive industrial and trade surplus data.

In economic news, industrial production in Germany rose 0.20% on a monthly basis in February, more than market expectations for a rise of 0.10%. Industrial production had fallen by a revised 0.40% in the prior month. Meanwhile, the nation’s trade surplus expanded to €19.20 billion in February, from a surplus of €15.90 billion in the previous month, while markets expectations were expecting a surplus of €19.00 billion.

Separately, the IMF confirmed that Greece made a crucial payment of €460 million to the fund, thus ending rumours that the nation would not be able to service its IMF bailout plan.

In the US, number of people claiming initial jobless benefits climbed to 281.00 K in the week ended 04 April, compared to market expectations of a rise to a level of 283.00 K. In the prior week, initial jobless claims had registered a revised reading of 267.00 K. Meanwhile, wholesale inventories advanced 0.30% on a MoM basis in February, in the US, compared to a revised advance of 0.40% in the prior month, while markets were anticipating it to climb 0.20%.

In the Asian session, at GMT0300, the pair is trading at 1.0669, with the EUR trading marginally higher from yesterday’s close.

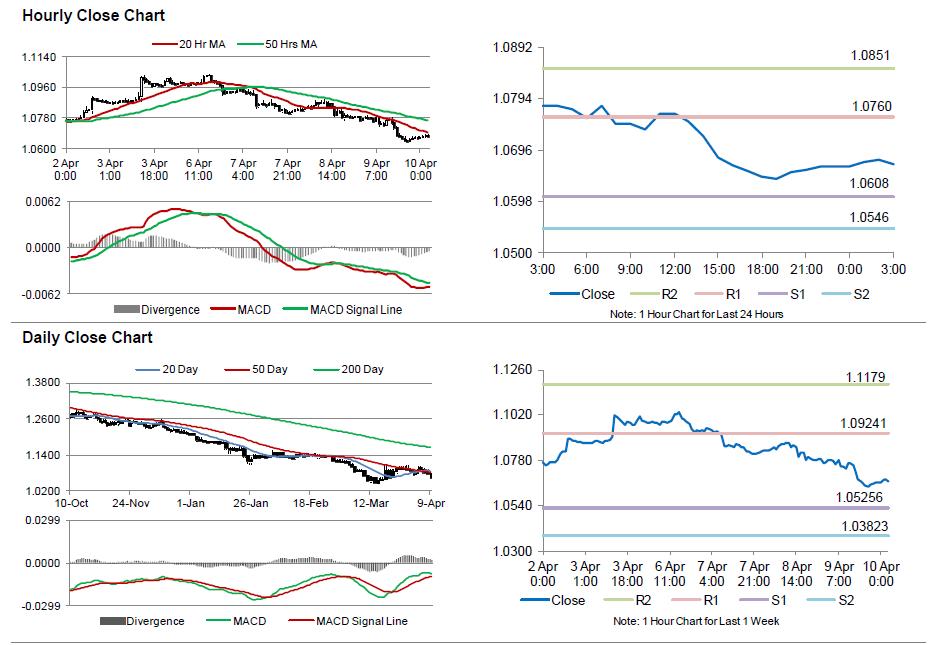

The pair is expected to find support at 1.0608, and a fall through could take it to the next support level of 1.0546. The pair is expected to find its first resistance at 1.076, and a rise through could take it to the next resistance level of 1.0851.

Amid no economic releases in the Euro-zone today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.