For the 24 hours to 23:00 GMT, the EUR declined 0.81% against the USD and closed at 1.1279.

The greenback traded on a stronger footing after the Fed in its first monetary policy meeting of 2015 expressed optimism over the US economic growth, citing strong improvement in jobs market. Additionally, the central bank reiterated that it would be “patient” in deciding when to raise interest rates from the current low levels. Meanwhile, it kept its key interest rate unchanged at 0.25%, in line with market expectations.

In other economic news, MBA mortgage applications dropped 3.2% on a weekly basis in the week ended 23 January 2015. It had risen by a revised 16.10% in the previous week.

Elsewhere, in Germany, the Gfk consumer confidence index rose to a 13-year high level of 9.3 in February, compared to market expectations of an advance to 9.1. In the prior month, the consumer confidence index had registered a level of 9.00. Meanwhile, in France, the consumer confidence index remained steady at a level of 90.0 in January, compared to market expectations of a rise to 91.00.

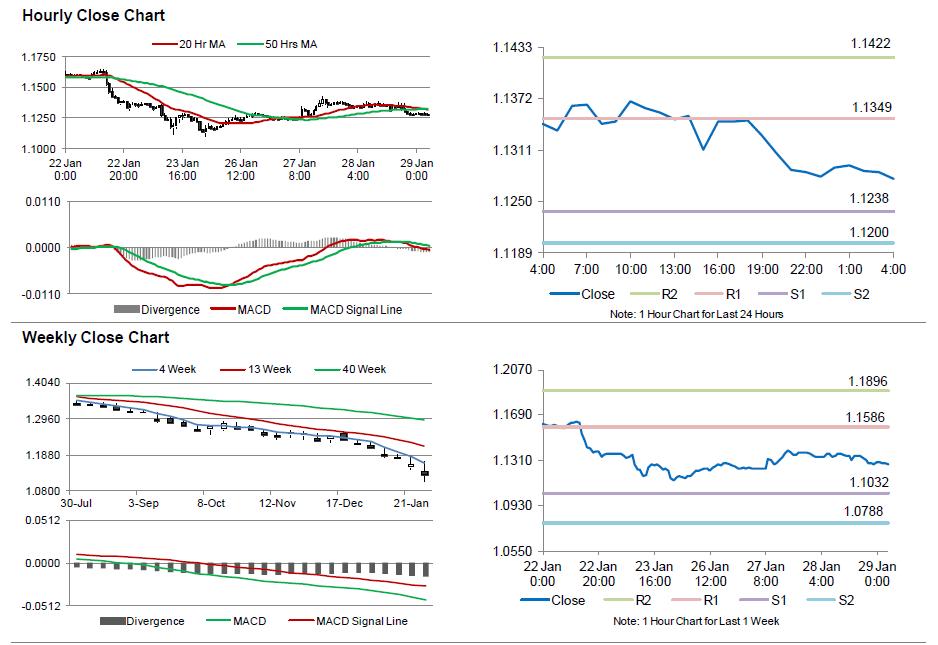

In the Asian session, at GMT0400, the pair is trading at 1.1277, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1238, and a fall through could take it to the next support level of 1.1200. The pair is expected to find its first resistance at 1.1349, and a rise through could take it to the next resistance level of 1.1422.

Trading trends in the Euro today are expected to be determined by Germany’s CPI, unemployment data, scheduled in few hours. Meanwhile, the US weekly initial jobless claims data would also grab a lot of market attention, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.