For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1491, following downbeat economic releases in the Euro-zone.

Data showed that Euro-zone’s final services PMI remained steady at a 14-month low level of 53.1 in April, compared to market expectations of an advance to a level of 53.2. The preliminary figures had indicated a rise to 53.2. Additionally, retail sales declined more-than-expected by 0.5% MoM in March, falling for the first time in five months, indicating that the region’s economic recovery remains modest and vulnerable to setbacks. Markets were expecting retail sales to drop 0.1%, following a revised rise of 0.3% in the previous month. Meanwhile in Germany, the final services PMI fell to a six-month low level of 54.5 in April, compared to a level of 55.1 in the previous month. Markets were expecting it to remain steady at the preliminary reading of 54.6.

The greenback gained ground, as economic data releases painted a mixed picture of the US economy.

The US trade deficit narrowed to a 16-month low level of $40.4 billion in March, less than market expectations of a trade deficit of $41.1 billion. The nation had reported a revised trade deficit of $47.0 billion in the previous month. Additionally, the final Markit services PMI climbed to a level of 52.8 in April, from a reading of 51.3 in the previous month Markets were expecting Markit services PMI to remain steady at the preliminary reading of 52.1.

On the other hand, the nation’s ADP private sector employment rose less-than-expected by 156.0K in April, its lowest figure in three years, compared to market anticipation for an advance of 195.0K. The private sector employment had registered a gain of 200.0K in the prior month

In other economic news, the US ISM non-manufacturing PMI rose more-than-expected to a level of 55.7 in April, compared to a level of 54.5 in the prior month. Market anticipation was for the non-manufacturing PMI to rise to 54.8. Moreover, the nation’s factory orders rebounded 1.1% in March, compared to a revised fall of 1.9% in the previous month, indicating that the downturn in manufacturing was nearing an end. Market expectation was for factory orders to rise 0.6%.

In the Asian session, at GMT0300, the pair is trading at 1.1487, with the EUR trading marginally lower from yesterday’s close.

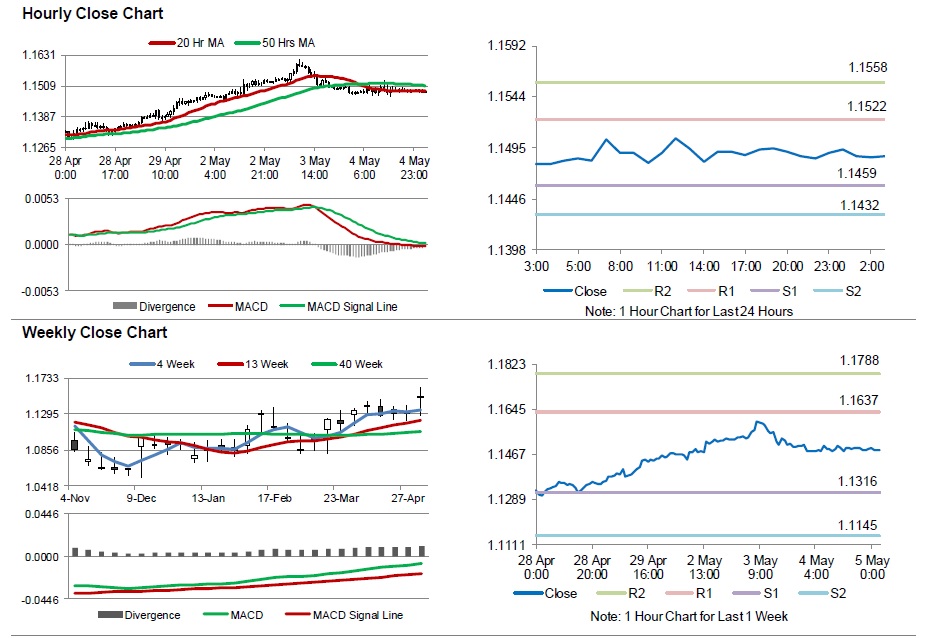

The pair is expected to find support at 1.1459, and a fall through could take it to the next support level of 1.1432. The pair is expected to find its first resistance at 1.1522, and a rise through could take it to the next resistance level of 1.1558.

Going ahead, investors will look forward to the ECB’s economic bulletin, scheduled to release in a few hours. Additionally, the US initial jobless claims data, due later in the day, will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.