For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.2384.

On the economic front, Germany’s import price index rose 1.1% YoY in December, in line with market expectations and compared to an advance of 2.7% in the prior month.

Macroeconomic data showed that personal spending in the US grew 0.4% on a monthly basis in December, meeting market estimates and after recording a revised gain of 0.8% in the previous month. Moreover, the nation’s personal income climbed more-than-anticipated by 0.4% on a monthly basis in December, while markets were expecting for an increase of 0.3%. Personal income had registered a rise of 0.3% in the prior month.

Other data revealed that the Dallas Fed manufacturing business index registered an unexpected rise to a level of 33.4 in January, notching a more than 12-year high level and confounding market expectations for a drop to a level of 25.4. In the previous month, the index had registered a level of 29.7.

In the Asian session, at GMT0400, the pair is trading at 1.2378, with the EUR trading marginally lower against the USD from yesterday’s close.

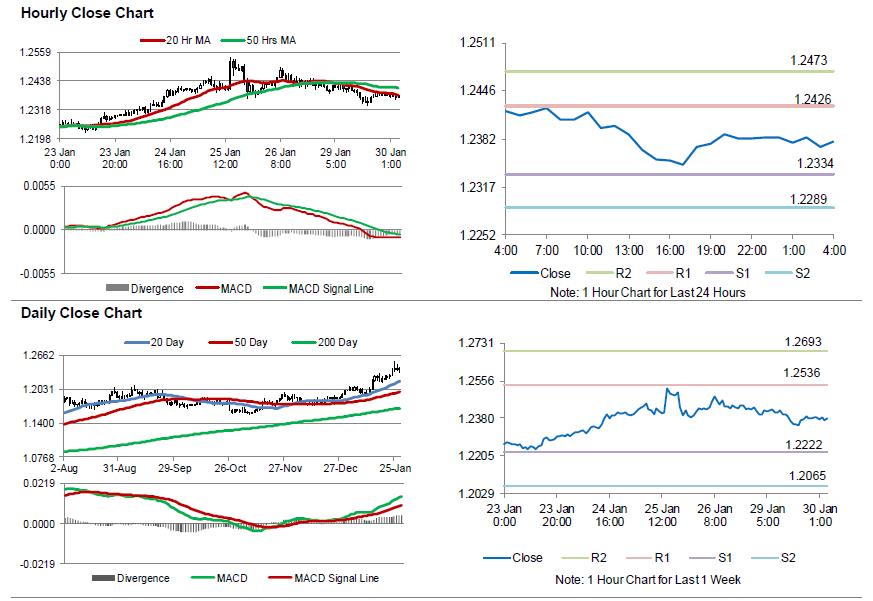

The pair is expected to find support at 1.2334, and a fall through could take it to the next support level of 1.2289. The pair is expected to find its first resistance at 1.2426, and a rise through could take it to the next resistance level of 1.2473.

Trading trend in the Euro today is expected to be determined by the release of the Euro-zone’s flash 4Q GDP numbers as well as Germany’s consumer price inflation data for January, both scheduled to release in a few hours. Additionally, the US consumer confidence index for January, due to release later in the day, would garner significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.