For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.1158.

In economic news, Germany’s final consumer price index rose in line with investor expectations by 0.4% MoM in February. The preliminary figures had also indicated a rise of 0.4%.

In the US, the import price index fell less-than-expected by 0.3% MoM in February, compared to a revised fall of 1.0% in the previous month. Markets were expecting the import price index to fall 0.7%.

In the Asian session, at GMT0400, the pair is trading at 1.1157, with the EUR trading marginally lower from Friday’s close.

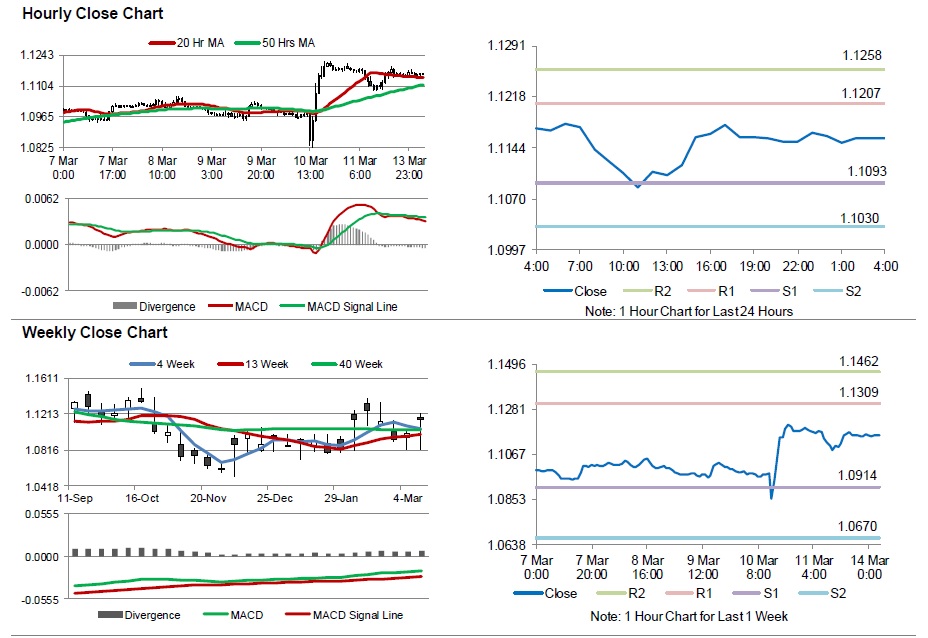

The pair is expected to find support at 1.1093, and a fall through could take it to the next support level of 1.1030. The pair is expected to find its first resistance at 1.1207, and a rise through could take it to the next resistance level of 1.1258.

Going ahead, investors will look forward to the Euro-zone’s industrial production data for January, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.