For the 24 hours to 23:00 GMT, the EUR rose 1.31% against the USD and closed at 1.1117, after the preliminary estimate of consumer price inflation edged up in Germany on an annual basis in April.

Data showed that the preliminary consumer price index in Germany recorded a rise of 0.40% in April on an annual basis, in line with market expectations. The consumer price index had climbed 0.30% in the prior month.

The greenback lost ground, after the US economic growth’s pace slowed down more than expected during the first quarter of 2015.

Data released yesterday indicated that the flash annualized GDP in the US recorded a rise of 0.20% on a quarterly basis in 1Q 2015, less than market expectations for an advance of 1.00%. In the previous quarter, it had registered a rise of 2.20%.

The greenback further came under pressure, after the Fed cited weakness in the US economy due to cold weather and strength of the dollar. It also removed any calendar reference to an anticipated interest rate hike and added it would be appropriate to hike interest rates when it sees further improvement in the labour market and the inflation moving towards its target of 2.0% over the medium term.

In other economic news, pending home sales in the US advanced 1.10% MoM in March, compared to a revised rise of 3.60% in the prior month. Market anticipations were for it to climb 1.20%.

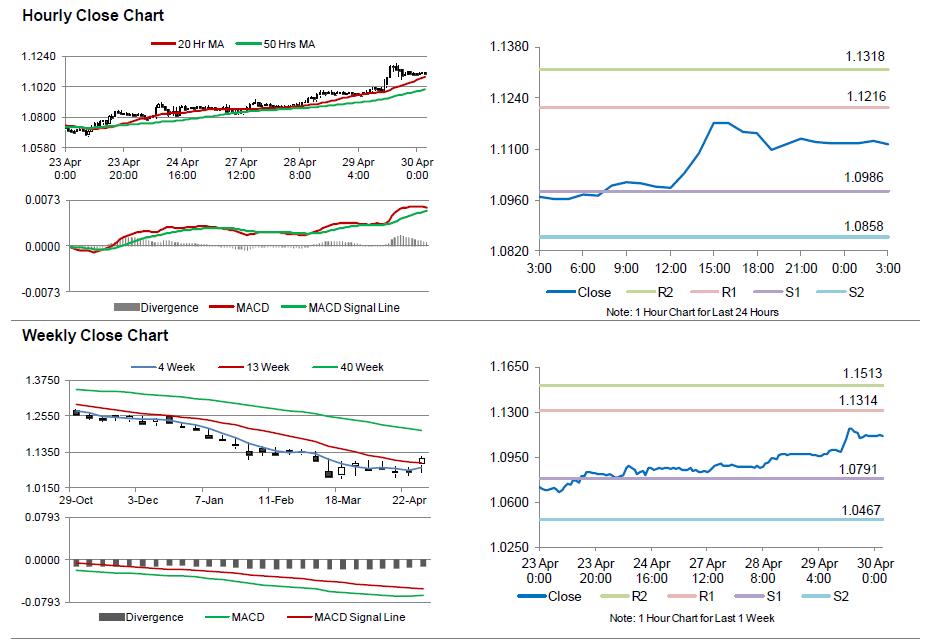

In the Asian session, at GMT0300, the pair is trading at 1.1115, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0986, and a fall through could take it to the next support level of 1.0858. The pair is expected to find its first resistance at 1.1216, and a rise through could take it to the next resistance level of 1.1318.

Trading trends in the Euro today are expected to be determined by Germany’s crucial unemployment rate coupled with the Euro-zone’s CPI data, scheduled in a few hours. Meanwhile, initial jobless claims data from the US, scheduled later today would be closely monitored by investors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.